Retail Cash Flow Guide 2026

Why Cash Flow Management Matters for UK Retailers

The UK retail industry operates on notoriously tight margins—typically between 2-5% for most retailers according to the British Retail Consortium. Despite retail sales in the UK reaching £465 billion in 2024, profit margins continue to shrink due to rising costs, increased competition from online sellers, and changing consumer behaviours.

Retailers face unique cash flow challenges that distinguish them from other business sectors:

- Inventory investment ties up significant capital—UK retailers hold an average of £2.3 million in stock at any given time, representing the largest single use of working capital

- Seasonal fluctuations mean 30-40% of annual revenue occurs in Q4 for many retailers, creating dramatic cash flow swings throughout the year

- Payment processing delays of 2-5 days for card transactions can create temporary cash shortfalls, especially during high-volume periods

- High fixed costs including rent, business rates, and staffing—UK retail rents average £25-50 per square foot in high streets, with business rates adding substantial overhead

- Supplier payment terms typically require payment within 30-60 days while customers pay immediately, creating a timing mismatch

- Rising operational costs with UK inflation impacting wholesale prices by 8-15% since 2022, squeezing already thin margins

According to UK Finance, a staggering 82% of retail business failures are linked to cash flow problems rather than lack of profitability. This statistic underscores why understanding and managing cash flow is not just important—it's essential for survival.

Cash flow is everything in retail. You can have full shelves and happy customers, but if you can't pay your suppliers, you're finished. I've seen profitable shops close because they couldn't manage the timing of their money. — UK Retail Industry Expert

Understanding Your Retail Cash Flow Cycle

The retail cash conversion cycle—the time between paying for inventory and receiving payment from customers—is one of the most critical metrics for any retail business. UK retailers average 45-90 days for this cycle, though it varies significantly by sector and business model.

Understanding this cycle helps you identify where cash gets stuck and where you can make improvements to accelerate the flow of money through your business.

Cash Inflows for UK Retailers

Revenue streams in retail are diverse, and each has different timing implications for your cash flow:

- In-store sales - Card payments now represent 85% of UK retail transactions according to UK Finance. These typically settle in 2-3 business days, though some payment processors offer next-day or same-day settlement for an additional fee

- Online sales - Payment processors like Stripe and PayPal hold funds for 2-7 days for new merchants, though established accounts may receive faster settlement. This delay can be significant for retailers with high online sales volumes

- Click and collect - Pre-payment at the time of ordering improves your cash position and reduces no-show risk, making this a cash flow-friendly sales channel

- Gift cards - UK retailers sold £7 billion in gift cards in 2024. This represents immediate cash with future liability—excellent for cash flow but requiring careful tracking of unredeemed balances

- Trade sales - B2B customers typically pay on 30-day terms or longer, requiring different cash flow management approaches than consumer sales

Cash Outflows for UK Retailers

Understanding where your money goes is equally important as knowing where it comes from. Retail expenses typically fall into two categories:

Fixed Costs (25-35% of revenue)

These costs remain relatively constant regardless of sales volume and must be paid even during slow periods:

- Rent and business rates (UK business rates average 50p per £1 of rateable value, representing a significant fixed cost for high street retailers)

- Staff wages including the National Living Wage, which increased to £11.44/hour in April 2024—a 10% increase that directly impacts retail labour costs

- Utilities and energy costs (UK commercial energy costs rose 150% between 2021-2024, though they have since stabilised somewhat)

- Insurance, security systems, and compliance costs

- Software subscriptions for point-of-sale, inventory management, and accounting systems

Variable Costs (50-65% of revenue)

These costs fluctuate with sales volume and offer more flexibility in management:

- Cost of goods sold (typically 40-60% depending on category and markup strategy)

- Shipping, logistics, and delivery costs for online orders

- Card processing fees (1.5-3% of transaction value depending on card type and processor)

- Marketing, advertising, and promotional costs

- Packaging materials and supplies

Managing Inventory and Cash Flow

Inventory represents the largest cash drain for most retail businesses, yet it's also essential for generating sales. The challenge lies in finding the optimal balance—enough stock to meet customer demand without tying up excessive capital in slow-moving products.

Inventory Turnover Rate: The Key Metric

Understanding your inventory turnover rate is fundamental to cash flow management:

Inventory Turnover = Cost of Goods Sold ÷ Average Inventory Value

This metric tells you how many times per year you sell and replace your entire inventory. Higher turnover generally means better cash flow efficiency.

UK retail benchmarks vary significantly by category:

- Grocery and convenience: 14-20 turns per year (weekly stock rotation)

- Fashion and apparel: 4-6 turns per year (seasonal collections)

- Electronics and technology: 6-8 turns per year

- Furniture and home goods: 3-4 turns per year

- Jewellery and luxury goods: 1-2 turns per year

Stock Optimisation Strategies

Implementing effective inventory management practices can significantly improve your cash position:

- Just-in-time ordering reduces the amount of cash tied up in stock by ordering smaller quantities more frequently. This requires reliable suppliers and good demand forecasting but can dramatically improve cash flow

- Drop shipping for slow-moving or specialty items eliminates inventory risk entirely. While margins may be lower, the cash flow benefit can be substantial

- Consignment arrangements with suppliers for new product lines allows you to test products without upfront investment. You only pay for what sells

- Regular markdown cycles to clear slow-moving stock release tied-up cash. It's better to sell at a discount than hold dead stock indefinitely

- ABC analysis categorises inventory by value and velocity, helping you focus cash investment on your best-performing products while minimising investment in slow movers

Seasonal Cash Flow Planning for Retailers

UK retail is highly seasonal, and understanding these patterns is crucial for effective cash flow management. According to the British Retail Consortium, seasonal patterns create predictable but significant cash flow challenges:

- December accounts for 15-20% of annual retail sales, requiring substantial upfront investment in inventory during September-October

- Black Friday week generates approximately £8.7 billion in UK sales, concentrated in just a few days

- January sales drive high volume but at reduced margins, potentially straining cash flow as revenue drops post-Christmas while costs remain

- Summer sales in June-July are essential for clearing spring/summer stock before autumn ranges arrive

- Back to school (August-September) represents a significant sales period for certain retail categories

Building Cash Reserves for Seasonal Fluctuations

The key to surviving seasonal swings is building reserves during strong periods to fund operations during slow periods:

- Save 20-25% of peak season profits specifically for off-season cash needs

- Maintain a minimum of 3 months of fixed costs as a cash reserve at all times

- Arrange overdraft facilities or lines of credit before you need them—banks are more willing to lend when you're not desperate

- Consider invoice financing for B2B receivables to accelerate cash collection

- Plan major expenses and investments for periods when cash flow is strongest

Supplier Payment Strategies for Better Cash Flow

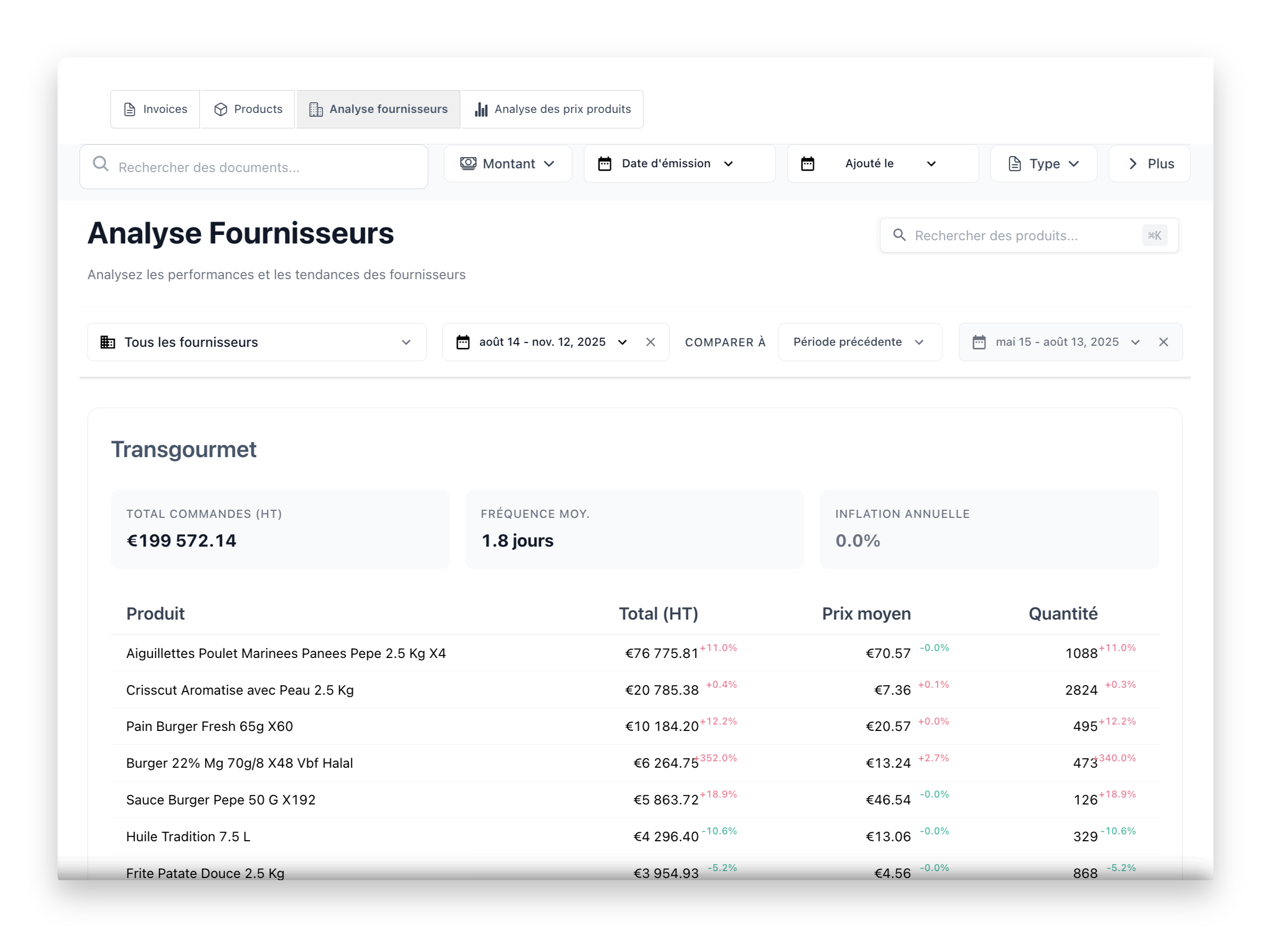

Your relationship with suppliers directly impacts cash flow. Effective supplier management can free up substantial working capital without requiring additional financing.

Negotiating Better Payment Terms

Payment terms are almost always negotiable, especially if you have a track record of reliable payment:

- Extended payment terms: Moving from Net-30 to Net-60 or Net-90 can significantly improve your cash position. For a retailer spending £100,000 monthly with suppliers, extending terms by 30 days effectively provides £100,000 of free financing

- Early payment discounts: Terms like 2/10 Net-30 (2% discount for payment within 10 days) can be valuable. A 2% discount for paying 20 days early equates to approximately 36% annualised return—often better than holding the cash

- Seasonal terms: Negotiate longer payment windows during your slow periods when cash is tightest

- Volume rebates: Annual rebates based on purchase volume provide a year-end cash boost

- Consignment stock: Pay only for goods as they sell, eliminating upfront inventory investment

Building Strong Supplier Relationships

Beyond negotiating terms, strong supplier relationships provide additional cash flow benefits:

- Priority allocation during stock shortages

- Flexibility during temporary cash flow difficulties

- Early access to new products and promotional opportunities

- Better pricing through volume commitments

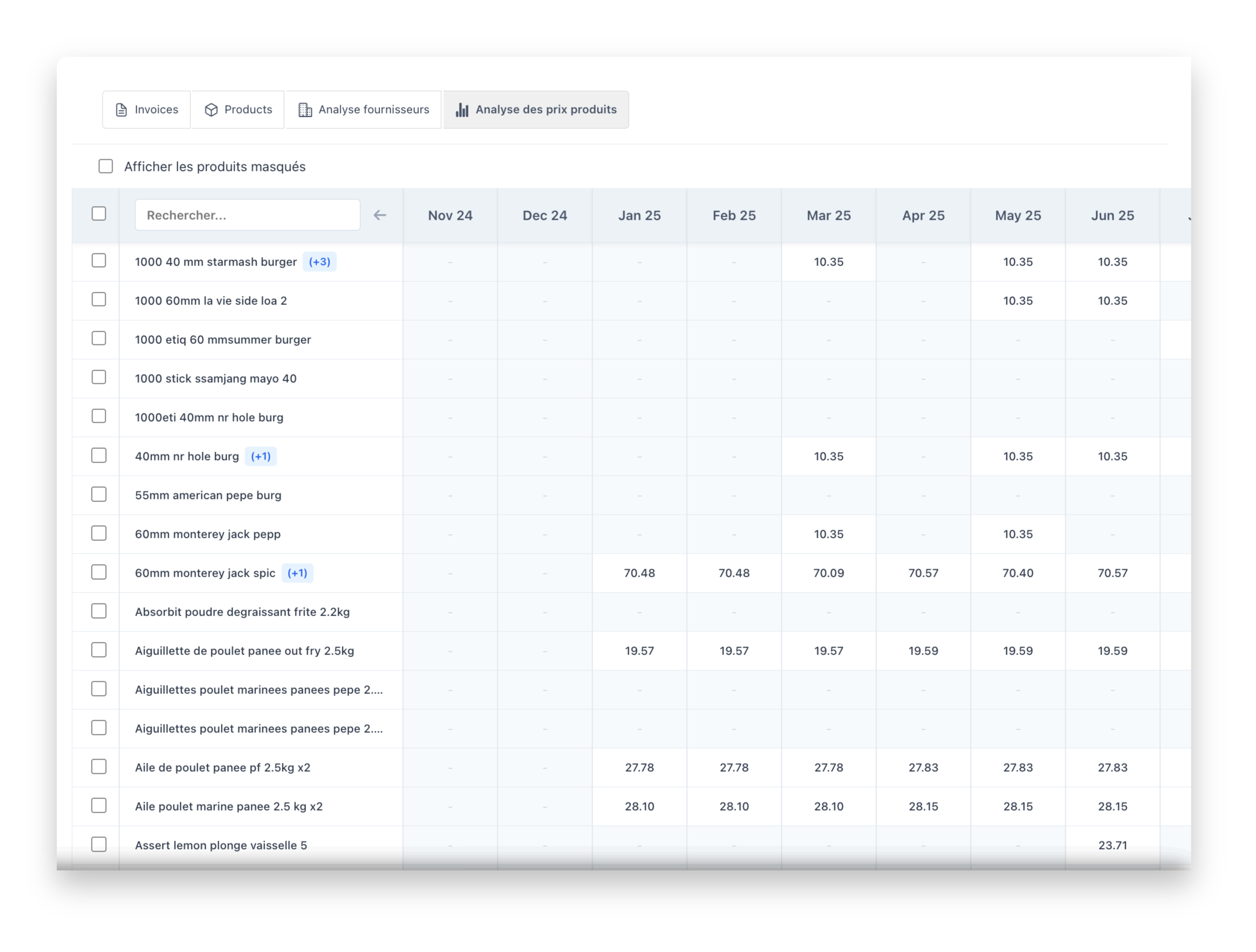

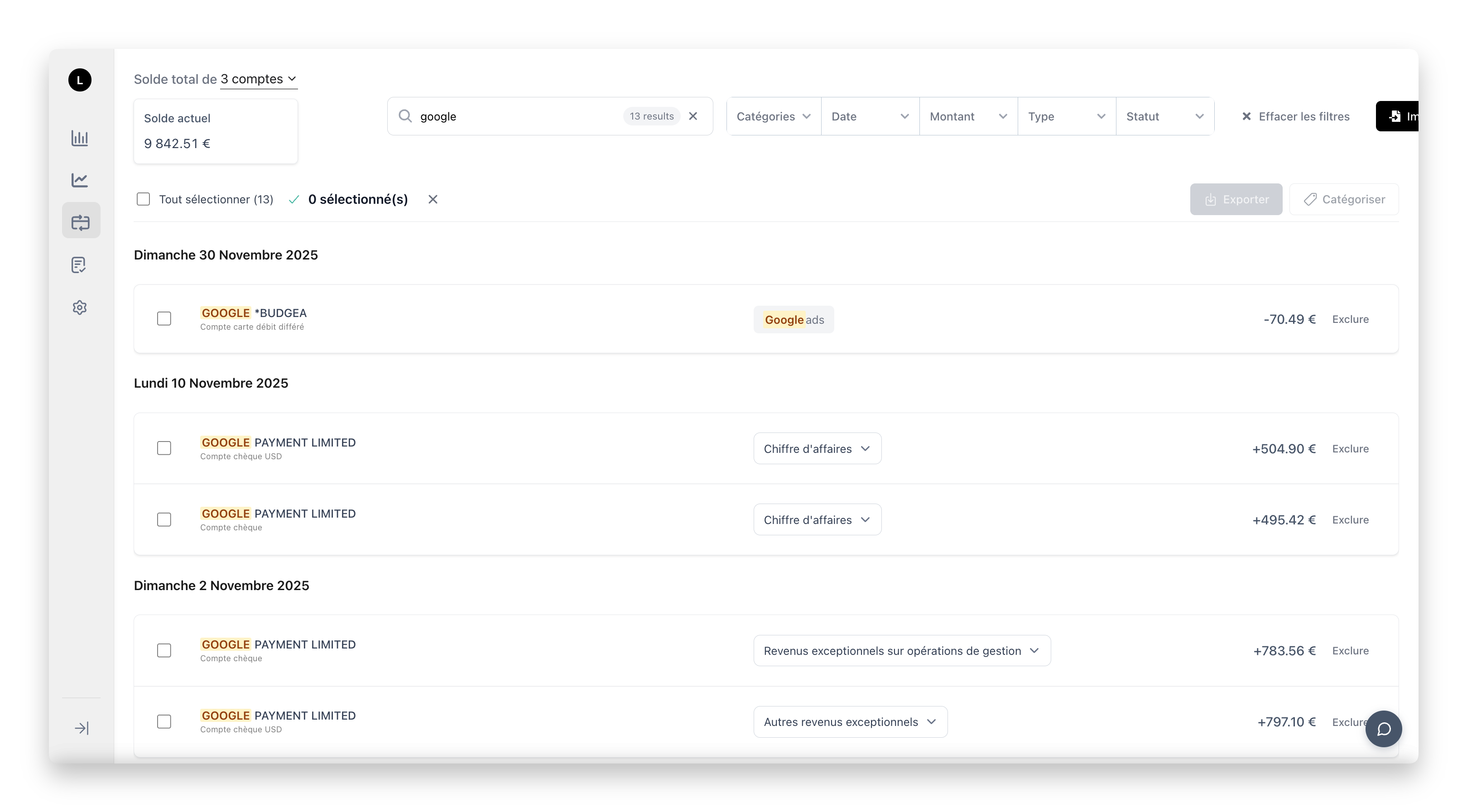

Technology for Retail Cash Flow Management

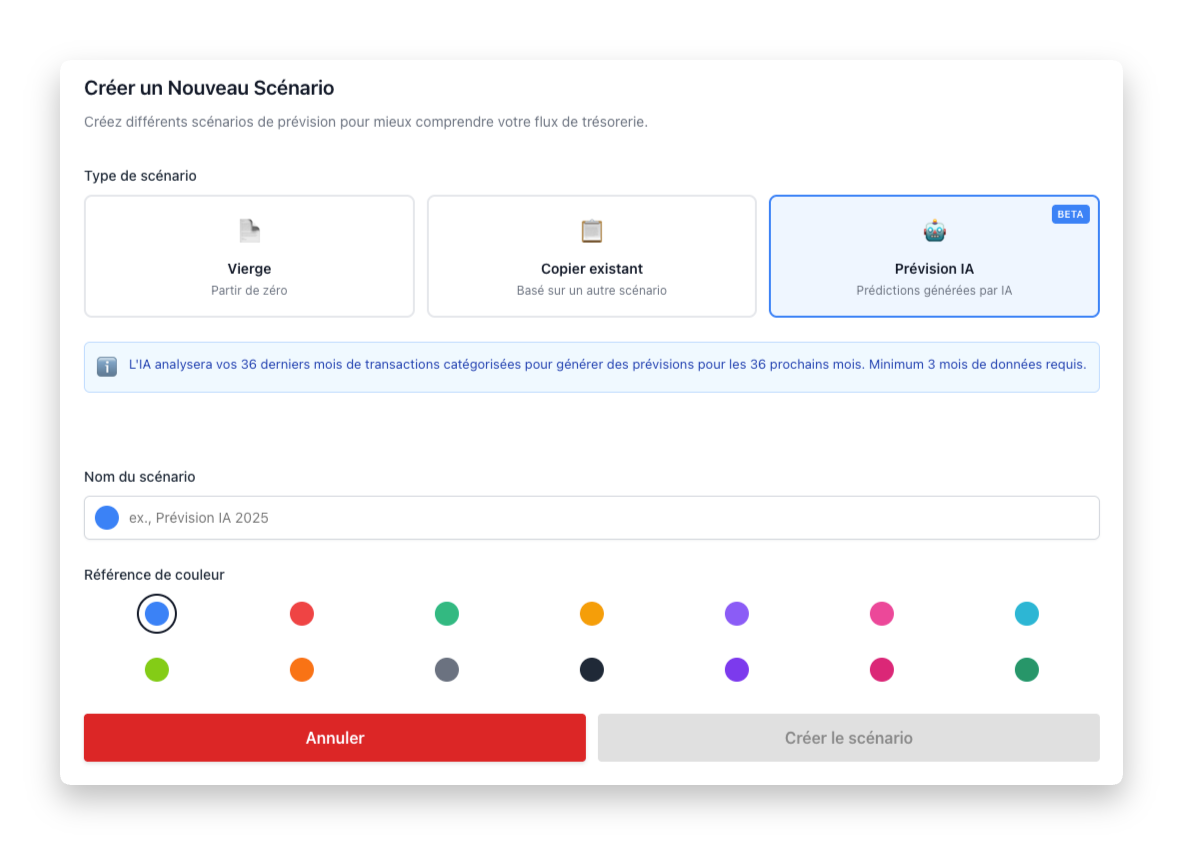

Modern technology has transformed cash flow management from a reactive, spreadsheet-based exercise into proactive, real-time financial control. The right tools can save hours of administrative work while providing better insights.

Essential Features for Retail Cash Flow Tools

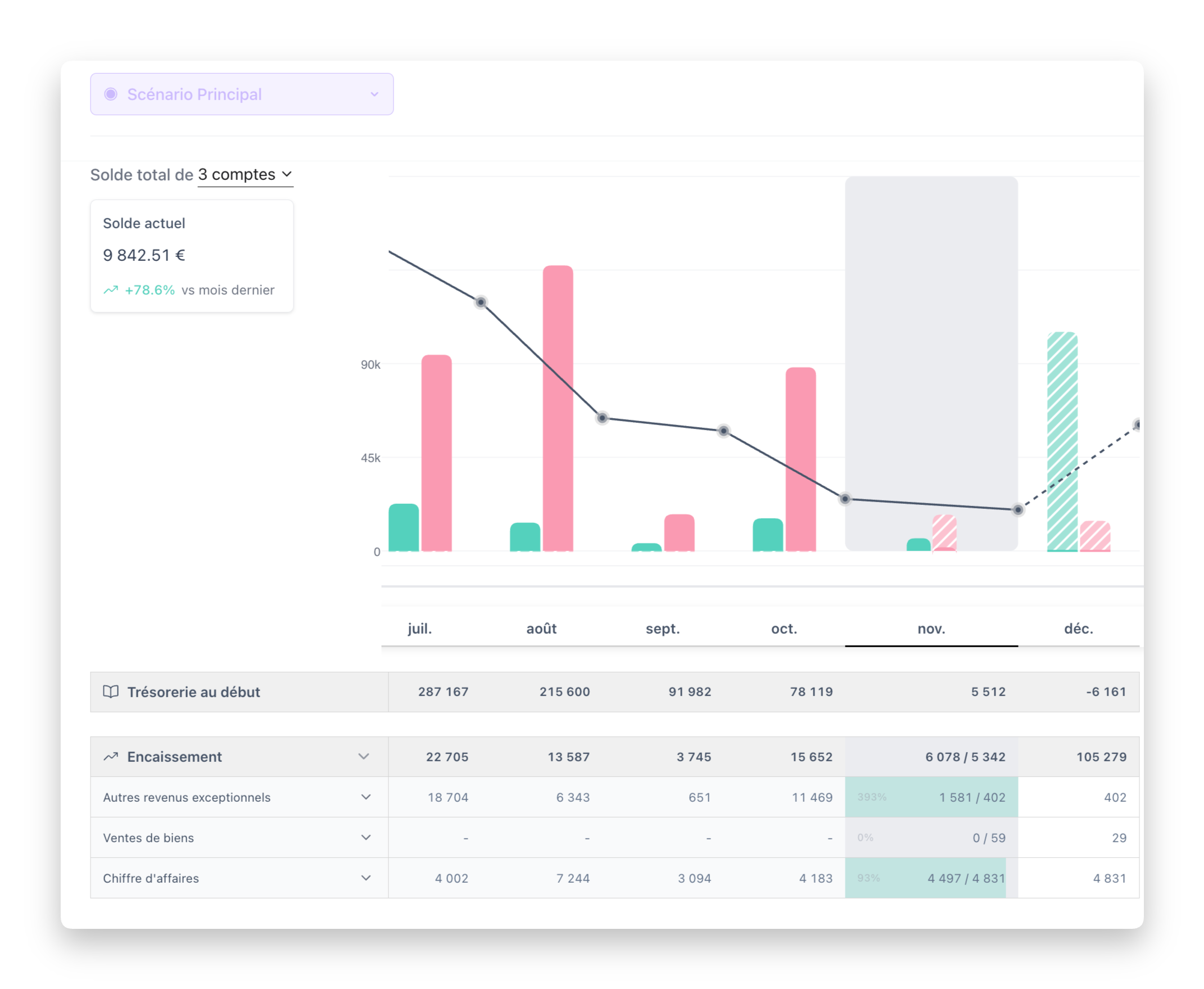

- Real-time bank feeds show your actual cash position across all accounts, updated automatically throughout the day

- AI-powered forecasting predicts cash shortfalls weeks or months in advance, giving you time to take action

- Automated categorisation saves hours of manual bookkeeping by intelligently sorting transactions

- Supplier analytics track spending patterns, price changes, and payment timing by vendor

- Multi-location consolidation provides a unified view across all store locations for retail chains

- Mobile access allows you to check your cash position from anywhere

- Alert systems notify you of low balances, unusual transactions, or upcoming cash shortfalls

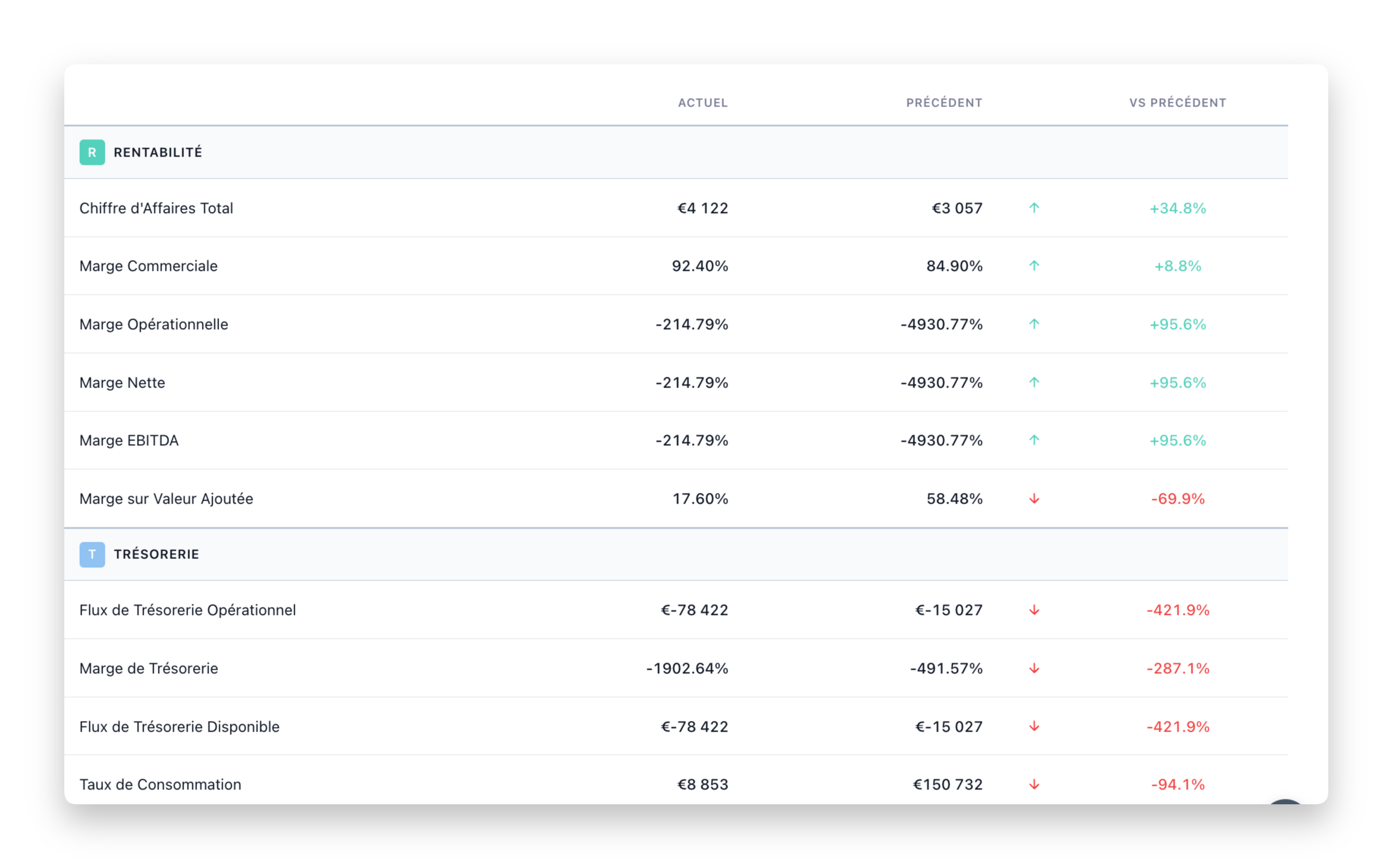

Key Metrics for Retail Cash Flow Success

Tracking the right metrics helps you identify problems early and measure the effectiveness of your cash flow management efforts. Monitor these KPIs weekly or even daily during critical periods:

- Cash conversion cycle: The number of days between paying for inventory and receiving payment from customers. Target: under 60 days for most retail categories

- Current ratio: Current assets ÷ current liabilities. Target: above 1.5, meaning you have 50% more assets than liabilities due within a year

- Quick ratio: (Current assets - inventory) ÷ current liabilities. Target: above 1.0, ensuring you can meet obligations even if inventory doesn't sell

- Gross margin return on inventory (GMROI): Gross profit ÷ average inventory cost. Target: above 2.0, meaning you earn £2 of gross profit for every £1 invested in inventory

- Sales per square foot: UK average is £500-800 for high street retail, though this varies significantly by location and category

- Days sales outstanding (DSO): For retailers with B2B sales, this measures how quickly you collect receivables

Warning Signs of Retail Cash Flow Problems

Recognising early warning signs allows you to take corrective action before a cash flow challenge becomes a crisis:

Early Warning Signs

- Regularly paying suppliers late or requesting extended terms

- Increasing reliance on credit cards or overdraft for routine expenses

- Declining cash reserves despite steady or growing sales

- Rising inventory levels without corresponding sales increases

- Decreasing profit margins that you can't explain

Serious Warning Signs

- Difficulty making payroll or delaying staff payments

- Bounced payments or failed direct debits

- Suppliers moving you to cash-on-delivery terms

- Unpaid VAT or PAYE obligations

- Regularly drawing on personal funds to cover business expenses

Action Steps for Better Retail Cash Flow

Improving cash flow requires consistent attention and systematic improvement. Here's a practical roadmap:

This Week

- Calculate your current cash conversion cycle using the formula above

- Review inventory turnover by category—identify your slowest-moving stock

- List your top 5 suppliers by spend and note their payment terms

- Check your current cash reserve level against 3 months of fixed costs

This Month

- Contact at least one major supplier to negotiate improved payment terms

- Implement weekly cash flow forecasting, even if just in a spreadsheet

- Review and markdown slow-moving inventory to release tied-up cash

- Set up automatic low-balance alerts on your bank accounts

- Review your payment processor terms—can you get faster settlement?

This Quarter

- Build your cash reserve to at least 3 months of fixed costs

- Implement a dedicated cash flow management tool for real-time visibility

- Review your pricing strategy to ensure margins cover rising costs

- Create a 12-month seasonal cash flow plan with specific targets and actions

- Establish a line of credit or overdraft facility for emergencies

Conclusion: Taking Control of Your Retail Cash Flow

Cash flow management is the difference between thriving and merely surviving in UK retail. The retailers who succeed long-term aren't necessarily those with the best locations or the most innovative products—they're the ones who understand how money flows through their business and actively manage that flow.

By understanding your cash conversion cycle, optimising inventory levels, building reserves for seasonal fluctuations, and leveraging modern technology for real-time visibility, you can build a more resilient retail business capable of weathering challenges and capitalising on opportunities.

The statistics are clear: most retail failures are cash flow failures. But with the right knowledge, tools, and discipline, you can ensure your business is among those that thrive rather than merely survive.

Start taking control of your retail cash flow today—your business depends on it.