SaaS Cash Flow Guide 2026

Why Cash Flow Management Matters for SaaS Companies

SaaS businesses face unique cash flow challenges unlike traditional businesses. According to SaaS Capital, the median UK SaaS company burns through 15-25% of ARR annually while scaling. The subscription model creates predictable revenue but also unique cash flow dynamics that every founder and finance leader must understand:

- Upfront customer acquisition costs—UK SaaS companies spend £1.20-1.50 to acquire every £1 of ARR, meaning you're investing heavily before seeing returns

- Revenue recognition timing—annual contracts paid upfront create deferred revenue obligations that look great for cash but complicate financial reporting

- High fixed costs—development, infrastructure, and talent costs remain constant regardless of revenue fluctuations

- Churn impact—UK B2B SaaS averages 5-7% annual revenue churn, which compounds over time and erodes your recurring revenue base

- Growth vs profitability trade-off—scaling requires significant cash investment before revenue materialises, creating negative cash flow periods

- Payment collection cycles—enterprise clients often demand 30-60 day payment terms, delaying cash receipt even after contracts are signed

- Currency exposure—UK SaaS companies selling internationally face GBP/USD and GBP/EUR fluctuations

Research by Barclays shows that 67% of UK tech startups cite cash flow management as their biggest operational challenge, ahead of hiring and product development.

In SaaS, cash is oxygen. You can have amazing metrics—great NRR, low churn, happy customers—but run out of cash and it's game over. I've seen too many promising companies die not from lack of product-market fit, but from running out of runway at the wrong moment. — UK SaaS Founder

Understanding the SaaS Cash Flow Model

The SaaS business model fundamentally inverts traditional cash flow patterns. Unlike a traditional business where you receive payment close to when you deliver value, SaaS companies invest heavily upfront to acquire customers who then pay over an extended period—often years.

This creates what's known as the SaaS cash flow trough—a period where cash outflows significantly exceed inflows while you build your customer base. Understanding this model is crucial for planning and survival.

The J-Curve Effect

Most growing SaaS companies experience negative cash flow in their early years. This is normal and expected—you're investing in future revenue. The key is understanding when you'll turn cash flow positive and ensuring you have sufficient runway to get there.

According to OpenView Partners, the median time to cash flow breakeven for SaaS companies is 5-7 years. UK companies often reach this milestone faster due to lower operating costs compared to US counterparts.

Key SaaS Metrics That Impact Cash Flow

Understanding these metrics is essential for managing cash effectively:

- Monthly Recurring Revenue (MRR)—your predictable monthly subscription income, the foundation of SaaS valuation

- Annual Recurring Revenue (ARR)—MRR × 12, the standard metric for SaaS company valuation (UK SaaS median is £2.3M ARR at Series A)

- Customer Acquisition Cost (CAC)—total sales and marketing spend ÷ new customers acquired in the period

- Lifetime Value (LTV)—average revenue per customer × average customer lifespan (in months or years)

- LTV:CAC Ratio—target 3:1 or higher for healthy unit economics; below 1:1 means you're losing money on every customer

- CAC Payback Period—months to recover acquisition cost (target under 12 months for venture-backed, under 18 for bootstrapped)

- Net Revenue Retention (NRR)—measures expansion minus churn; top UK SaaS companies achieve 110-130%

- Gross Revenue Retention (GRR)—measures retention without expansion; healthy benchmark is 85-95%

Cash Inflows for SaaS Companies

Understanding your cash inflow timing is critical for forecasting:

- Monthly subscriptions—predictable but collected over time; typical payment success rate is 95-98%

- Annual subscriptions—paid upfront, significantly improving cash position; best practice is offering 15-20% discount

- Multi-year contracts—enterprise deals often span 2-3 years with upfront or annual payment

- Implementation fees—one-time revenue for enterprise deployments; typically 10-25% of first-year ACV

- Professional services—consulting, training, customisation; can represent 5-15% of revenue for enterprise SaaS

- Usage-based revenue—variable component on top of base subscription; growing trend in UK SaaS

- Expansion revenue—upsells and cross-sells to existing customers; often the most profitable revenue source

Cash Outflows for SaaS Companies

Fixed Costs (typically 60-80% of total spend)

- Engineering salaries—40-50% of total costs for early-stage; UK average for senior developers is £70-90K

- Cloud infrastructure—AWS, GCP, Azure typically cost 15-25% of revenue; optimise with reserved instances

- Office and administrative costs—even with remote work, expect 5-10% of revenue

- SaaS tools and subscriptions—often 5-10% of revenue (the irony of SaaS companies paying for SaaS)

- Insurance and compliance—SOC 2, GDPR compliance, cyber insurance add up quickly

Variable Costs (20-40% of total spend)

- Sales commissions—typically 10-20% of ACV, paid upon booking or collection

- Marketing spend—paid acquisition, content marketing, events; often 20-40% of revenue for growth-stage

- Payment processing fees—Stripe, PayPal charge 2-3% of revenue

- Customer success and support costs—scale with customer count; often 5-10% of revenue

- Hosting costs—scale with usage; should decrease as % of revenue over time

Managing SaaS Cash Runway

Cash runway—the number of months until you run out of money—is arguably the most critical metric for growth-stage SaaS companies. It determines your strategic options, hiring plans, and fundraising timeline.

Calculating Your Runway

Runway (months) = Current Cash Balance ÷ Monthly Burn Rate

Example: £2M cash ÷ £150K monthly burn = 13.3 months runway

However, this simple calculation has important nuances:

- Gross burn—total monthly cash outflow, regardless of revenue

- Net burn—cash outflow minus cash inflow; more accurate for revenue-generating companies

- Adjusted runway—factors in planned changes to burn rate (new hires, reduced marketing)

Runway Benchmarks for UK SaaS

- Minimum safe runway: 12 months (absolute minimum; stressful for team and investors)

- Comfortable runway: 18-24 months (allows for strategic planning and market uncertainty)

- Ideal runway: 24-30 months (post-funding target for most venture-backed companies)

- Fundraising trigger: Start raising at 9-12 months runway (fundraising typically takes 3-6 months)

- UK average for seed-stage: 18 months post-funding

- UK average for Series A: 24 months post-funding

Extending Your Runway

When cash is tight, consider these strategies:

- Reduce burn rate—cutting costs is faster than increasing revenue

- Accelerate collections—offer discounts for immediate payment

- Delay major investments—postpone non-critical hires and projects

- Explore debt financing—venture debt, revenue-based financing

- Bridge funding—small rounds from existing investors

- R&D tax credits—UK SaaS companies can claim substantial cash back

Optimising Payment Collection

How you collect payments has a dramatic impact on cash flow. Small improvements can add months to your runway.

Annual vs Monthly Billing

Encouraging annual payments significantly improves cash flow and provides other benefits:

- Offer 15-20% discount for annual payment (industry standard; 20% for monthly = 2 months free)

- Make annual the default option in your pricing page (tested by Paddle to increase annual selection by 30%)

- Target 40-60% annual payment mix (UK SaaS average is 45%; top performers reach 70%)

- Consider multi-year deals with enterprise customers (2-3 year contracts with upfront payment)

- Highlight total savings for annual plans (Save £240/year is more compelling than 17% off)

The math is compelling: if your MRR is £100K and you shift from 30% annual to 60% annual, you receive £360K more cash upfront each year—potentially adding 2-3 months of runway.

Reducing Failed Payments

Failed payments (involuntary churn) typically account for 20-40% of total churn. This is silent revenue loss that many companies ignore:

- Implement smart retry logic—retry failed charges 3-4 times over 7-10 days; optimal times are mid-week, mid-day

- Send payment failure notifications immediately—email, in-app, SMS; multiple channels increase recovery

- Use account updater services—Stripe and others automatically refresh expired card details

- Offer multiple payment methods—cards, Direct Debit (GoCardless), bank transfer, PayPal

- Pre-dunning reminders—notify customers 7 days before card expiry

- Grace periods—maintain service for 7-14 days while resolving payment issues

According to ProfitWell, optimising payment recovery can reduce involuntary churn by 40-80%, translating directly to improved cash flow.

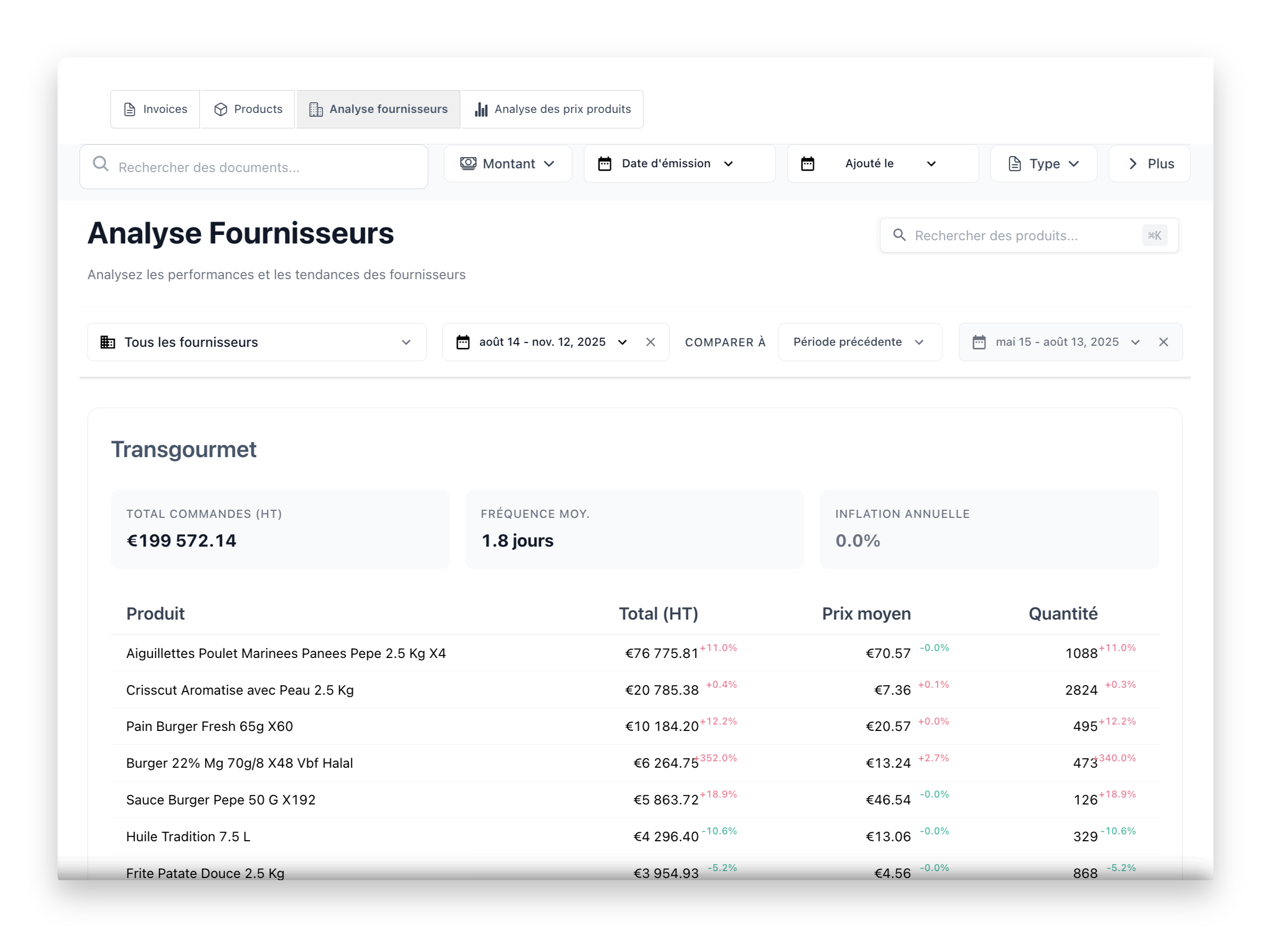

Enterprise Payment Considerations

Selling to enterprise creates different cash flow dynamics:

- Invoicing vs automatic billing—many enterprises require invoices and PO numbers

- Net-30 to Net-60 terms—standard for enterprise; factor this into cash planning

- Credit checks—assess enterprise customer creditworthiness for large deals

- Milestone-based payments—for implementation-heavy deals, tie payments to delivery milestones

UK-Specific SaaS Considerations

VAT Management

UK VAT rules significantly impact SaaS cash flow:

- Registration threshold—register for VAT once turnover exceeds £85,000 (2024/25 threshold)

- B2B EU sales—reverse charge applies post-Brexit; customer accounts for VAT

- B2C EU sales—must register for VAT OSS or in each EU country where sales exceed €10,000

- US sales—no VAT, but monitor sales tax nexus in individual states

- VAT timing—VAT is due on invoice date, not payment date; creates cash flow gap

- Consider VAT automation—services like Avalara, TaxJar, or Paddle handle compliance

R&D Tax Credits

R&D tax credits are often the largest cash flow opportunity for UK SaaS companies:

- Qualifying activities—software development, technical problem-solving, innovation

- SME scheme—enhanced deduction of 86% on qualifying costs (from April 2023)

- Loss-making companies—can receive cash credits worth up to 10% of qualifying spend

- Profitable companies—reduce corporation tax liability

- Typical UK SaaS claim—£50-200K annually for companies with 10-50 engineers

- RDEC scheme—for larger companies or those with grant funding

Example: A UK SaaS company with £500K in qualifying R&D costs can claim approximately £50K in cash credits if loss-making, or reduce their tax bill by £86K if profitable.

UK SaaS Funding Landscape

Understanding funding options helps with cash flow planning:

- SEIS/EIS—investors receive tax relief, making UK SaaS more attractive

- Venture debt—providers like Kreos, Silicon Valley Bank (UK), Columbia Lake Partners

- Revenue-based financing—Clearco, Uncapped, Pipe offer non-dilutive capital

- Government grants—Innovate UK, regional growth funds

Cash Flow Forecasting for SaaS

Accurate forecasting is essential for SaaS planning, fundraising, and board reporting.

Revenue Forecasting

Build your revenue forecast bottom-up:

- Start with existing MRR—your current baseline

- Apply expected churn—use historical churn rates; be conservative

- Add new business—based on sales pipeline and historical conversion rates

- Factor expansion revenue—upsells, cross-sells, price increases from existing customers

- Model seasonal variations—Q4 often strongest for B2B; January typically weakest

- Consider payment timing—annual vs monthly mix affects when cash arrives

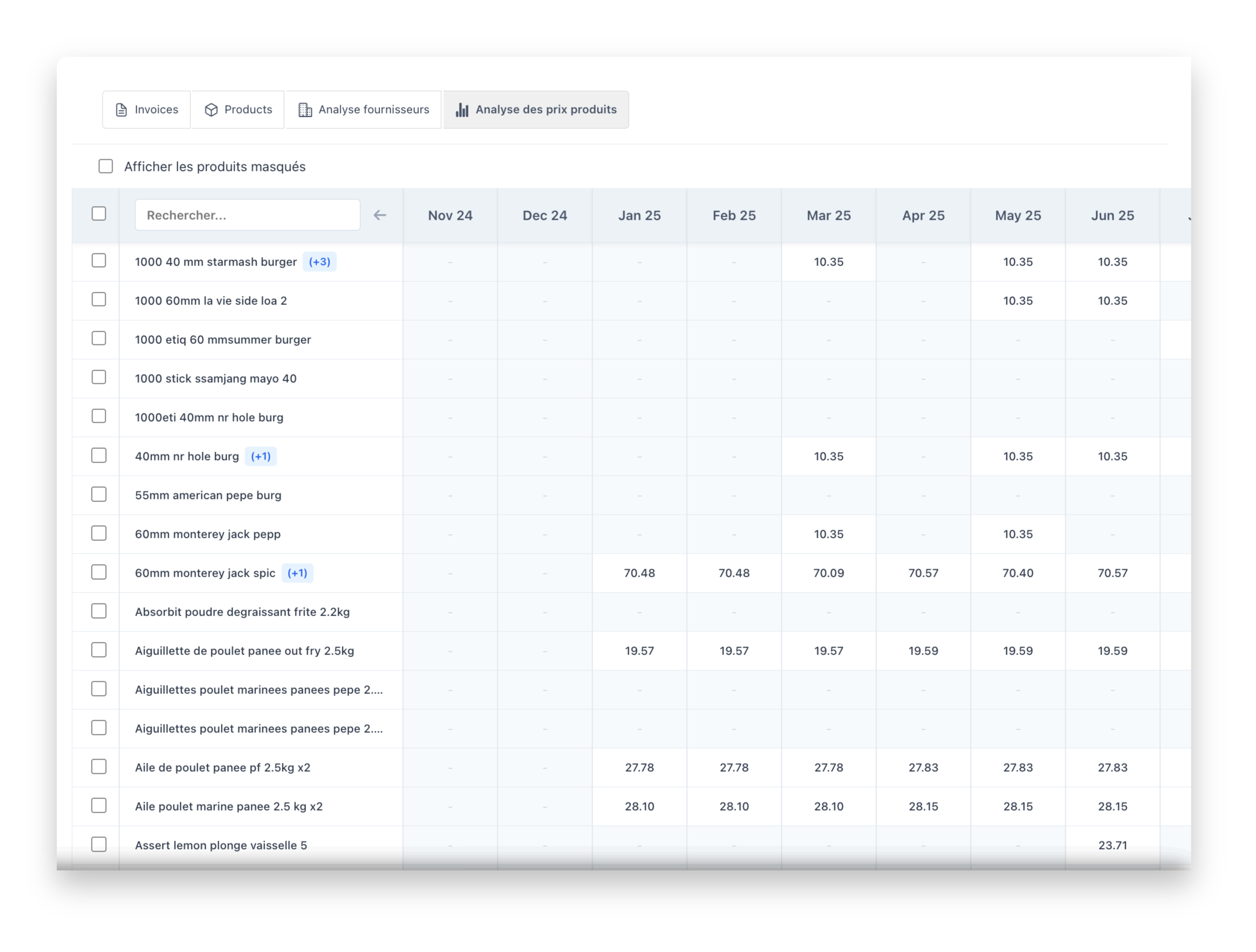

Expense Forecasting

- Model headcount growth—biggest expense; include recruitment costs and ramp time

- Plan infrastructure scaling—AWS/GCP costs grow with usage, not linearly

- Include one-time costs—equipment, office moves, conferences

- Marketing spend variability—may increase/decrease based on growth targets

- Build contingency buffer—10-15% for unexpected costs

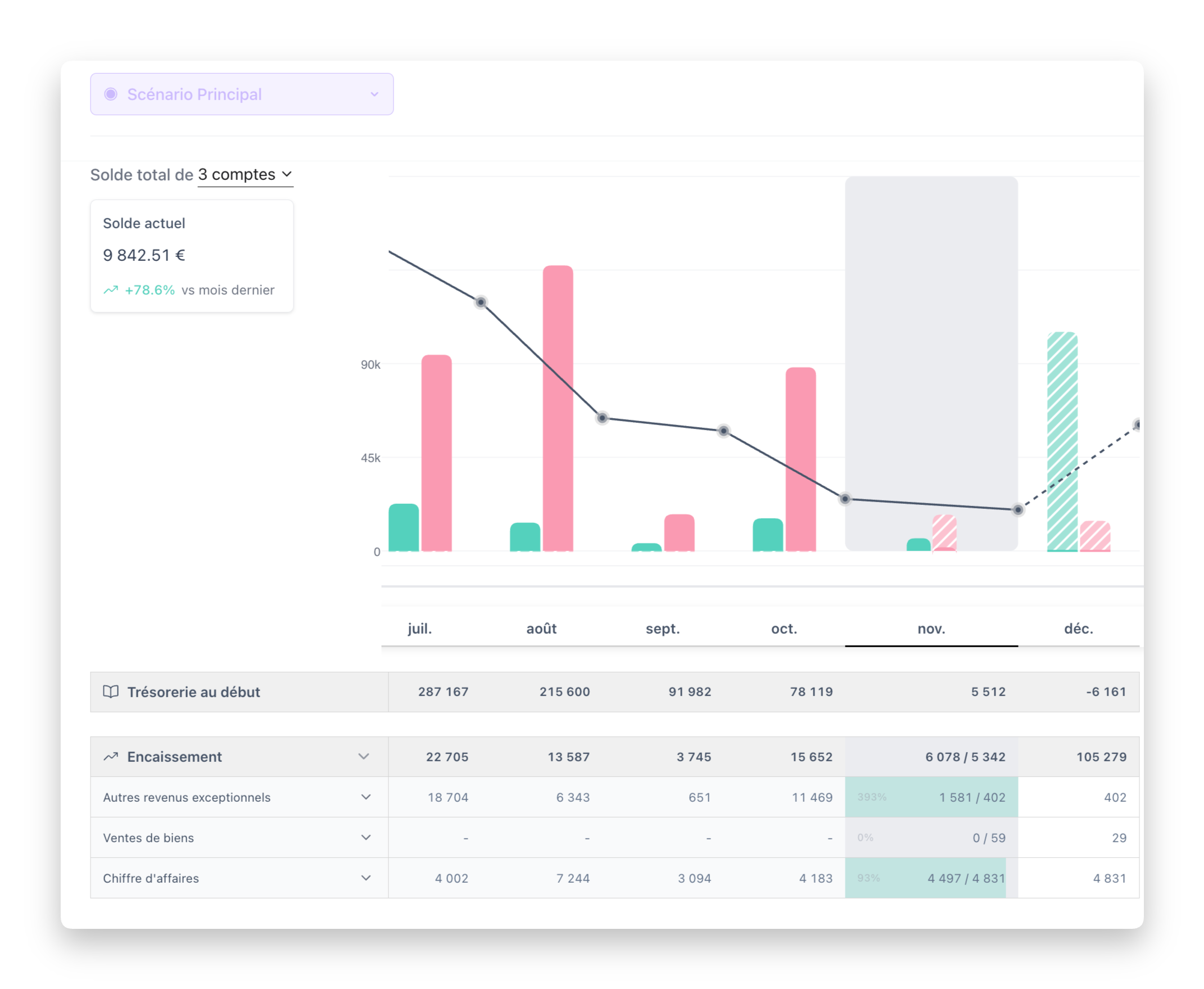

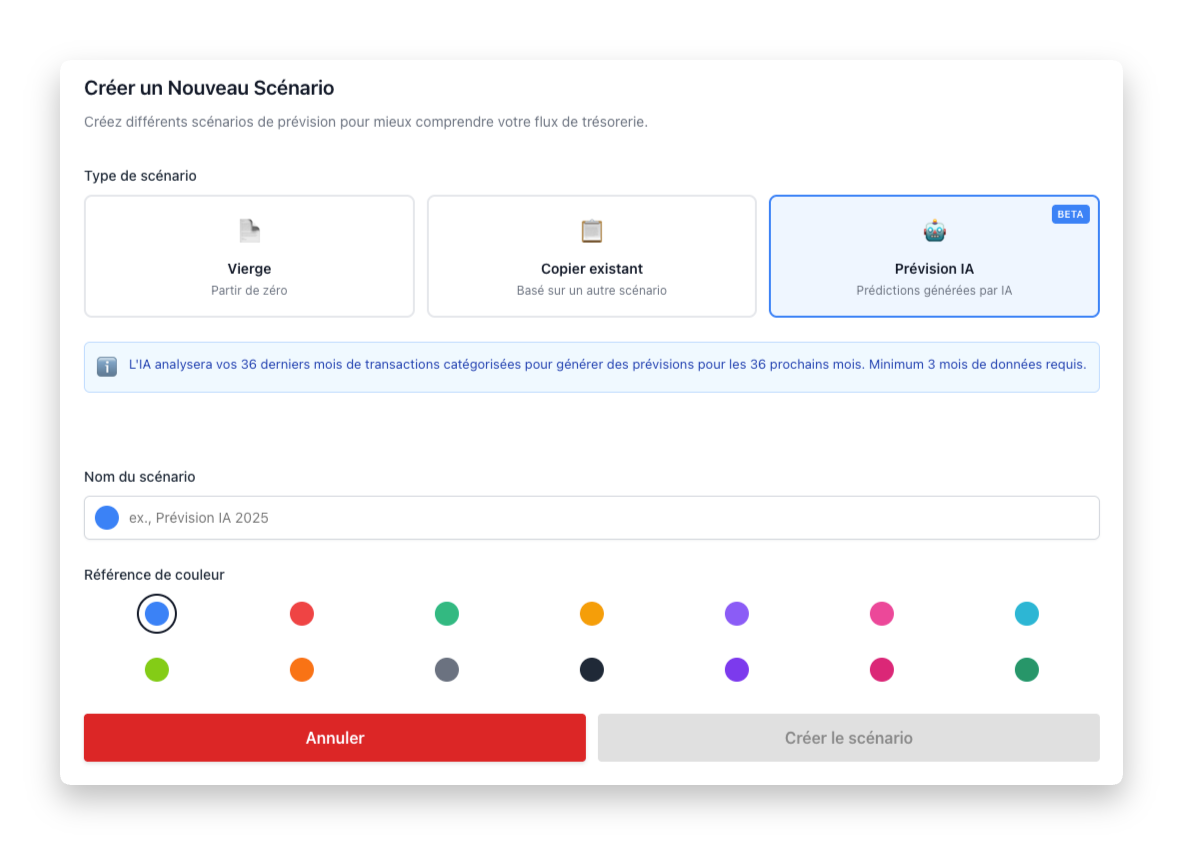

Scenario Planning

Always model multiple scenarios:

- Base case—your expected outcome based on current trajectory

- Upside case—things go better than expected (new enterprise deal, lower churn)

- Downside case—things go worse (major customer churns, sales miss targets)

- Crisis case—significant market downturn or major setback

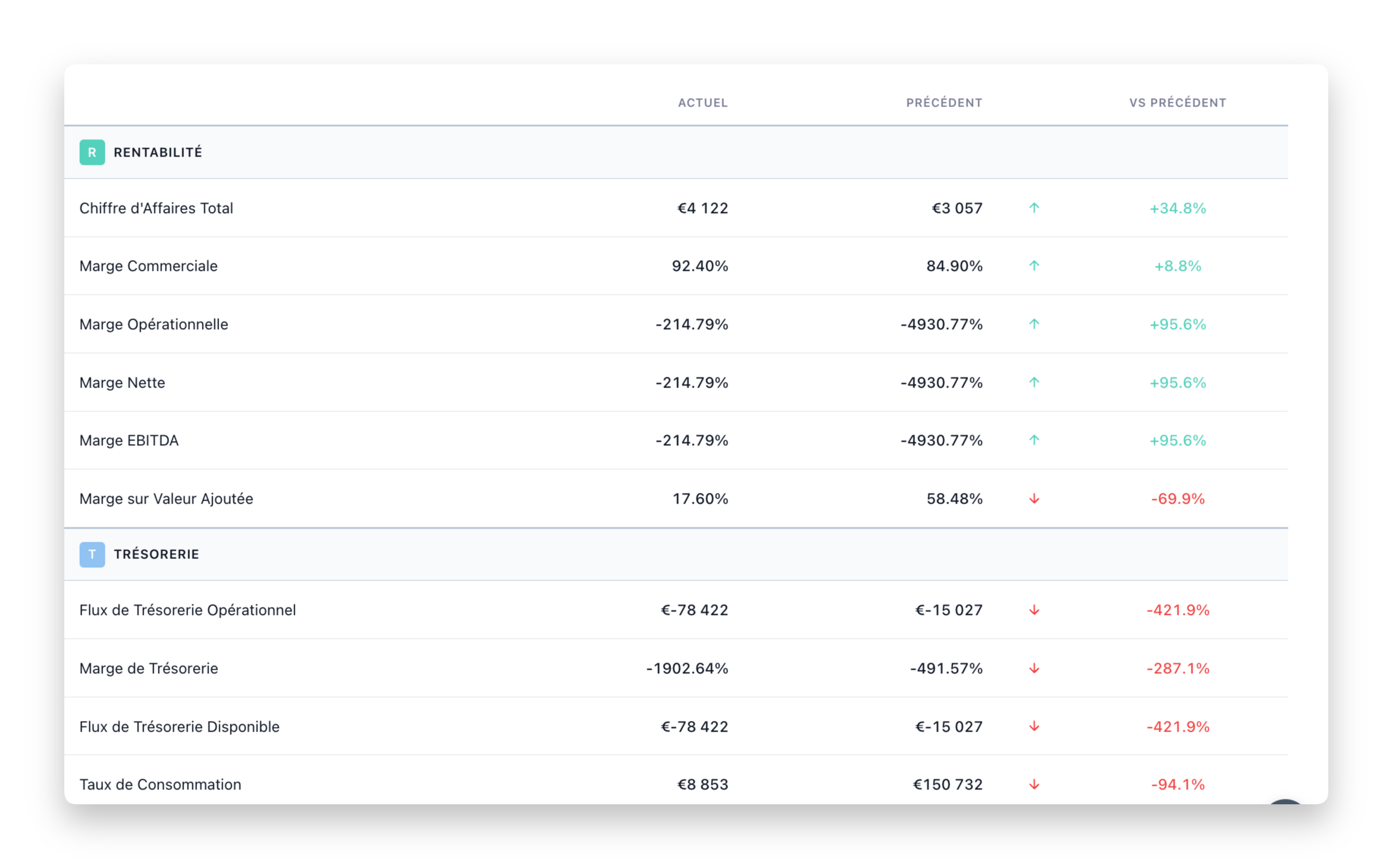

Warning Signs of Cash Flow Problems

Watch for these red flags that indicate emerging cash flow issues:

- Runway dropping below 12 months—triggers urgent action

- Burn rate increasing faster than revenue—unsustainable growth

- CAC payback extending beyond 18 months—unit economics deteriorating

- Churn accelerating—losing revenue faster than acquiring it

- Delayed vendor payments—early sign of cash stress

- Increasing reliance on credit—using credit cards for operating expenses

- Revenue collection slowing—DSO increasing month over month

Key SaaS Cash Flow Metrics to Track

Monitor these metrics weekly or monthly:

- Cash runway: Months of operation remaining at current burn rate

- Gross burn rate: Total monthly cash consumption

- Net burn rate: Burn rate minus revenue (true cash consumption)

- Gross margin: Target 70-80% for healthy SaaS (after hosting, support)

- CAC payback: Months to recover acquisition cost

- Rule of 40: Growth rate + profit margin ≥ 40% indicates healthy company

- Quick ratio: New MRR ÷ lost MRR; target above 4:1

- Days Sales Outstanding (DSO): Average collection time; target under 45 days

Action Steps for Better SaaS Cash Flow

This Week

- Calculate your current cash runway using both gross and net burn

- Review your annual vs monthly billing mix—identify opportunities

- Identify your top 5 expense categories—where is cash going?

- Check your failed payment recovery rate—is money slipping away?

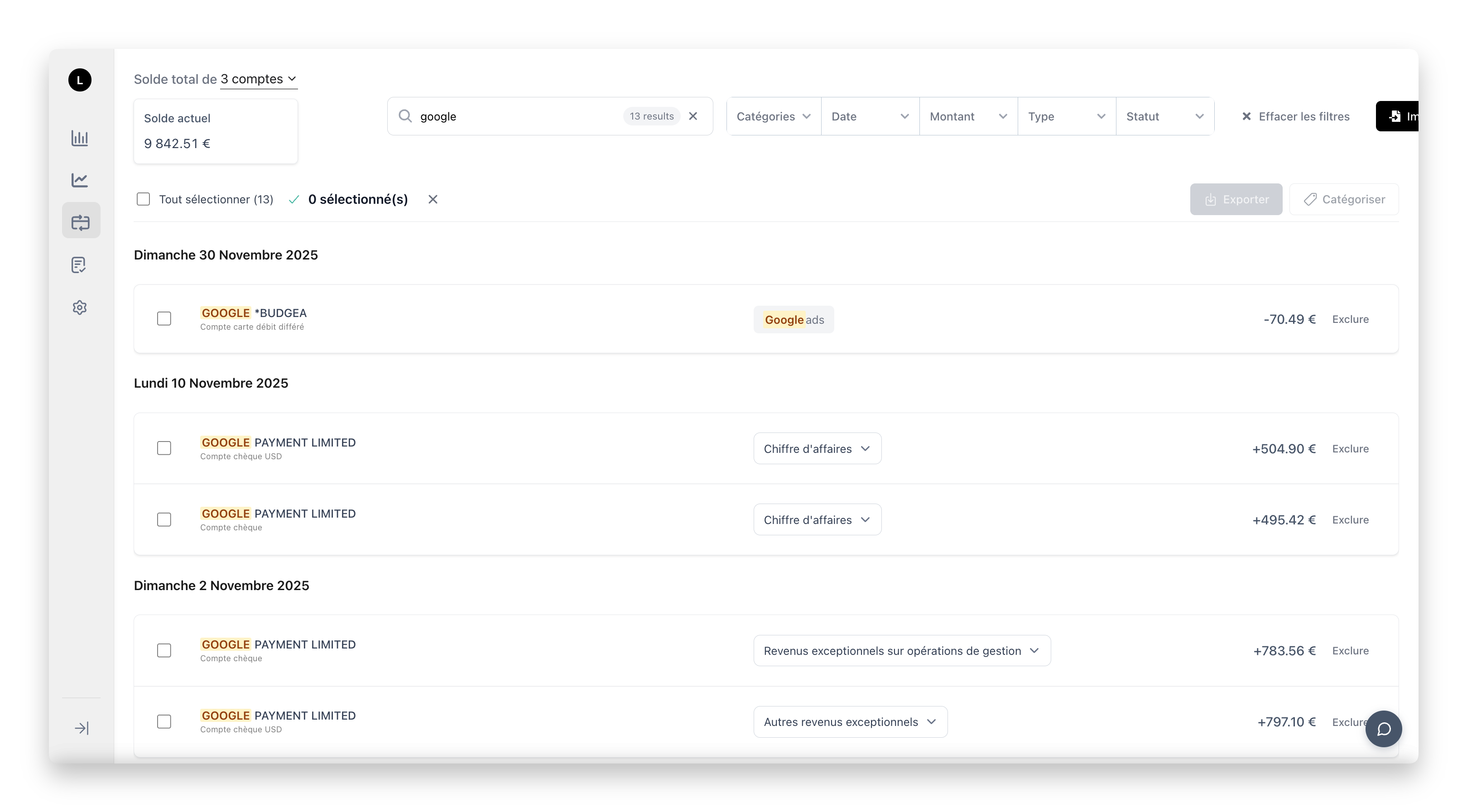

- Pull your last 3 months of cash flow data—identify patterns

This Month

- Implement or improve dunning workflows to recover failed payments

- Create a 13-week rolling cash flow forecast

- Review vendor contracts for savings opportunities—negotiate renewals

- Model scenarios: base case, upside, and downside

- Review pricing—are you leaving money on the table?

This Quarter

- Build runway to 18+ months if currently below

- Implement comprehensive cash flow management tooling

- Increase annual payment mix to 50%+ of customers

- Explore R&D tax credit claims—engage a specialist

- Review your SaaS stack for redundant or underutilised tools

Conclusion

SaaS cash flow management requires balancing growth investment against financial sustainability. The subscription model provides predictable revenue but demands careful attention to collection timing, runway management, and unit economics.

By understanding your key metrics, optimizing payment collection, maintaining adequate runway, and leveraging UK-specific opportunities like R&D tax credits, you can build a financially resilient SaaS business that survives market volatility and thrives long-term.

The most successful UK SaaS companies aren't just building great products—they're masters of cash flow management. Start taking control of your SaaS cash flow today.