Restaurant Cash Flow Guide 2026

Why Cash Flow Management Matters for Restaurants

The restaurant industry operates on notoriously thin margins—typically between 3-9%. Unlike other businesses, restaurants face unique cash flow challenges that can quickly turn a profitable month into a financial crisis:

- Daily cash handling from multiple payment sources including cash, credit cards, mobile payments, and delivery platforms

- Perishable inventory that must be purchased regularly and cannot be stored indefinitely

- Seasonal fluctuations in customer traffic that can vary by 40-60% between peak and slow periods

- High fixed costs including rent, utilities, insurance, and staff wages that must be paid regardless of revenue

- Variable supplier payment terms ranging from COD to net-60 depending on your relationship and credit history

- Unexpected expenses from equipment breakdowns, health inspections, or emergency repairs

According to the National Restaurant Association, cash flow problems are the leading cause of restaurant closures—ahead of location issues or poor food quality. A study by Cornell University found that 26% of restaurant failures are directly attributed to poor financial management and inadequate cash reserves.

Cash flow is the lifeblood of any restaurant. You can have the best food in town, but if you can't pay your suppliers or staff, you won't survive. — Restaurant industry veteran

Understanding Your Restaurant's Cash Flow Cycle

Before you can manage cash flow effectively, you need to understand how money moves through your restaurant. The typical restaurant cash flow cycle is more complex than most retail businesses because of the perishable nature of inventory and the timing mismatches between when you pay for supplies versus when you receive payment from customers.

Cash Inflows: Where Your Money Comes From

Understanding your revenue streams is the first step to managing cash flow:

- Dine-in sales - Cash and credit card payments received same-day or within 2-3 business days

- Takeout and delivery - Direct orders paid immediately; third-party platforms pay weekly or bi-weekly

- Catering and events - Often require deposits (typically 50%) with final payment on delivery

- Gift card sales - Immediate cash but creates future liability

- Merchandise sales - Branded items, sauces, or packaged goods

- Loyalty program redemptions - Track carefully as they affect actual revenue recognition

Cash Outflows: Where Your Money Goes

Restaurant expenses fall into several categories, each with different timing and flexibility:

Fixed Costs (30-35% of revenue)

- Rent or mortgage payments

- Insurance (liability, property, workers' comp)

- Loan repayments

- Base utilities

- Management salaries

- Software subscriptions (POS, accounting, scheduling)

Variable Costs (55-65% of revenue)

- Food and beverage inventory (25-35%)

- Hourly labor costs (25-35%)

- Variable utilities

- Cleaning supplies and disposables

- Credit card processing fees (2-4%)

- Delivery platform commissions (15-30%)

The key to healthy cash flow is ensuring your inflows consistently exceed your outflows while maintaining enough reserves to handle unexpected expenses. Industry experts recommend maintaining a cash reserve equal to 3-6 months of fixed costs.

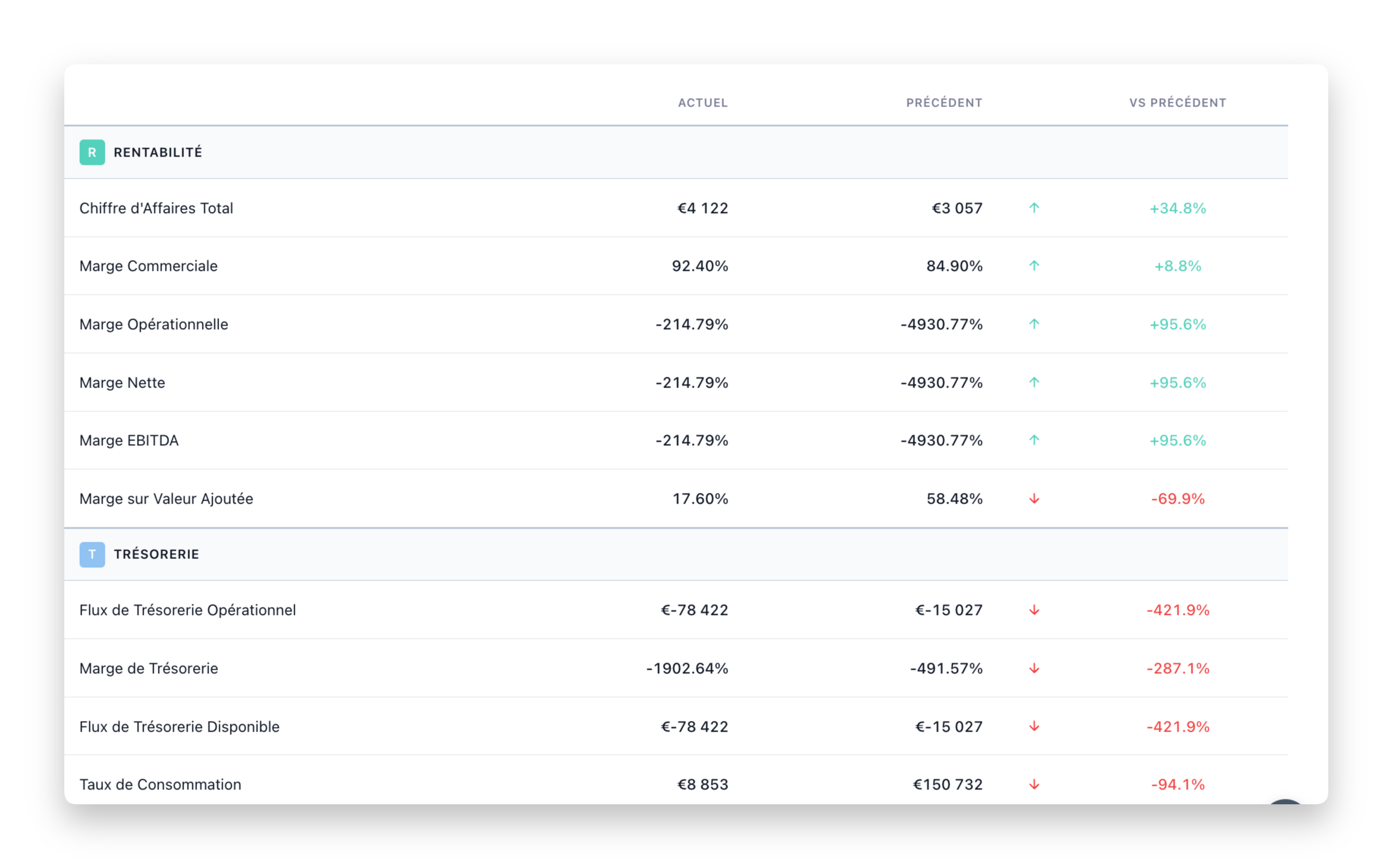

Calculating Your Break-Even Point

One of the most important calculations for any restaurant owner is the break-even point—the amount of sales needed to cover all costs before generating any profit. Understanding this number helps you set realistic goals and make informed decisions about pricing, staffing, and expansion.

Use our free Break-Even Calculator to determine exactly how much revenue you need to stay profitable.

The Break-Even Formula

Break-Even Point = Fixed Costs ÷ (1 - Variable Cost Percentage)

For example, if your monthly fixed costs are €15,000 and your variable costs represent 60% of revenue:

Break-Even = €15,000 ÷ (1 - 0.60) = €15,000 ÷ 0.40 = €37,500 per month

This means you need to generate at least €37,500 in monthly revenue just to cover costs. Anything above this is profit; anything below means you're losing money.

Daily and Weekly Break-Even Targets

Converting your monthly break-even to daily and weekly targets makes it actionable:

- Daily break-even (if open 26 days/month): €37,500 ÷ 26 = €1,442/day

- Weekly break-even: €37,500 ÷ 4.3 = €8,721/week

- Per-cover target (at €25 average check): 58 covers per day minimum

Managing Seasonal Cash Flow Fluctuations

Most restaurants experience significant seasonal variations in revenue. Tourist destinations see summer spikes, while downtown business districts may slow during holidays. Understanding and planning for these fluctuations is essential for survival.

Identifying Your Seasonal Patterns

Start by analyzing at least 24 months of historical sales data to identify:

- Peak months and their revenue levels

- Slow months and how deep the dip goes

- Weekly patterns (typically weekends vs. weekdays)

- Holiday impacts (both positive and negative)

- Weather-related fluctuations

- Local event impacts (conventions, festivals, sports events)

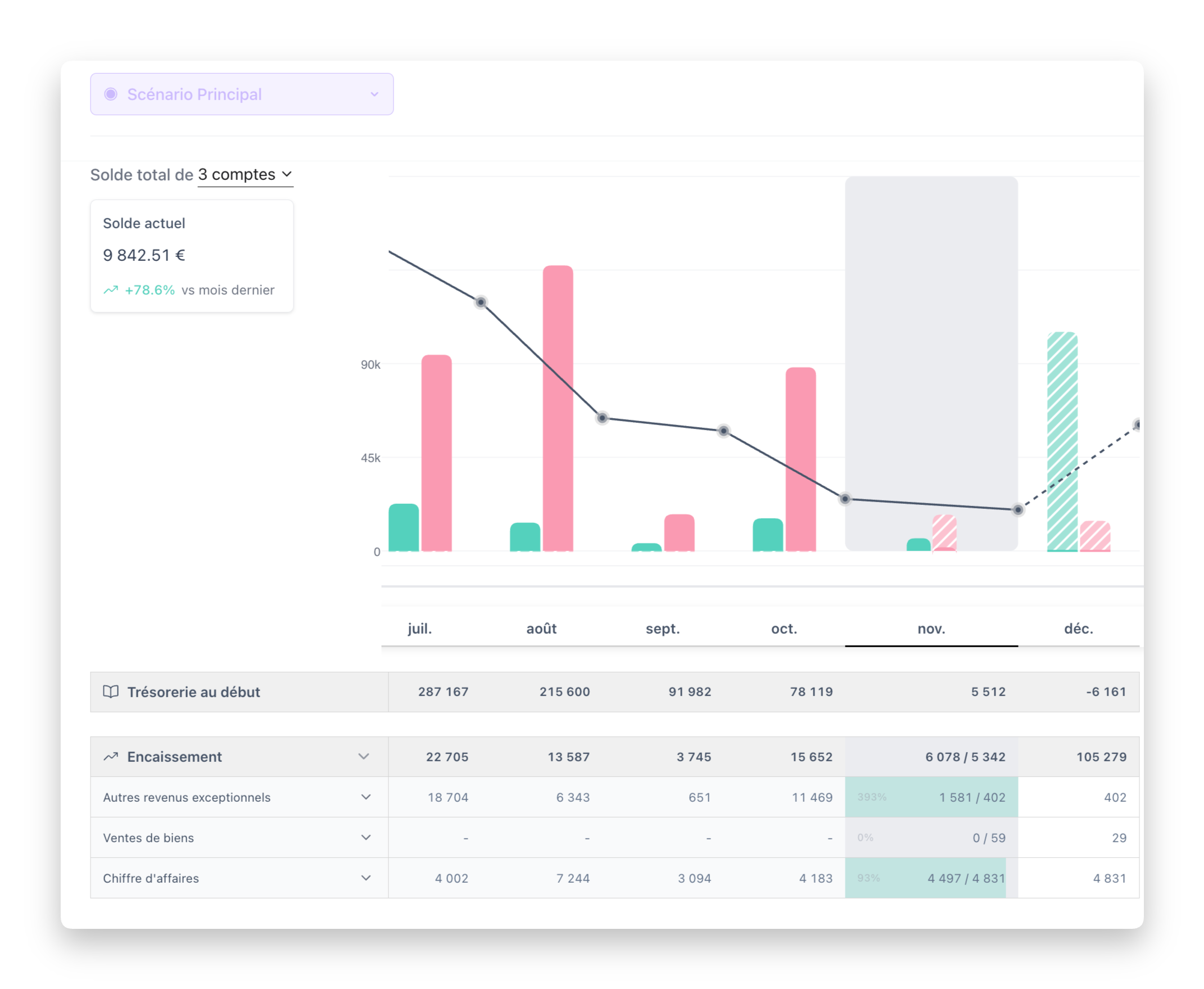

Modern cash flow management tools can automatically detect these patterns and alert you to upcoming cash shortages months in advance.

1. Build Cash Reserves During Peak Seasons

The cardinal rule of restaurant cash management: save during good times to survive the slow times.

- Aim to set aside 15-20% of peak season profits as reserves

- Create a separate savings account specifically for slow-season cash needs

- Target a reserve equal to 3-6 months of fixed costs

- Don't use peak profits for expansion until reserves are adequate

2. Implement Dynamic Staffing Models

Labor is your second-largest expense and the most flexible. Smart scheduling can save 10-15% on labor costs:

- Use historical data to predict covers and staff accordingly

- Cross-train staff to work multiple positions

- Implement split shifts during slow periods with busy lunch and dinner

- Maintain a pool of reliable part-time workers for peak periods

- Consider reduced hours or days during consistently slow periods

3. Negotiate Seasonal Terms with Suppliers

Strong supplier relationships can provide crucial flexibility:

- Request extended payment terms (net-45 or net-60) during slow months

- Negotiate volume discounts in exchange for year-round commitment

- Arrange for reduced minimum orders during off-peak periods

- Build relationships with multiple suppliers for negotiating leverage

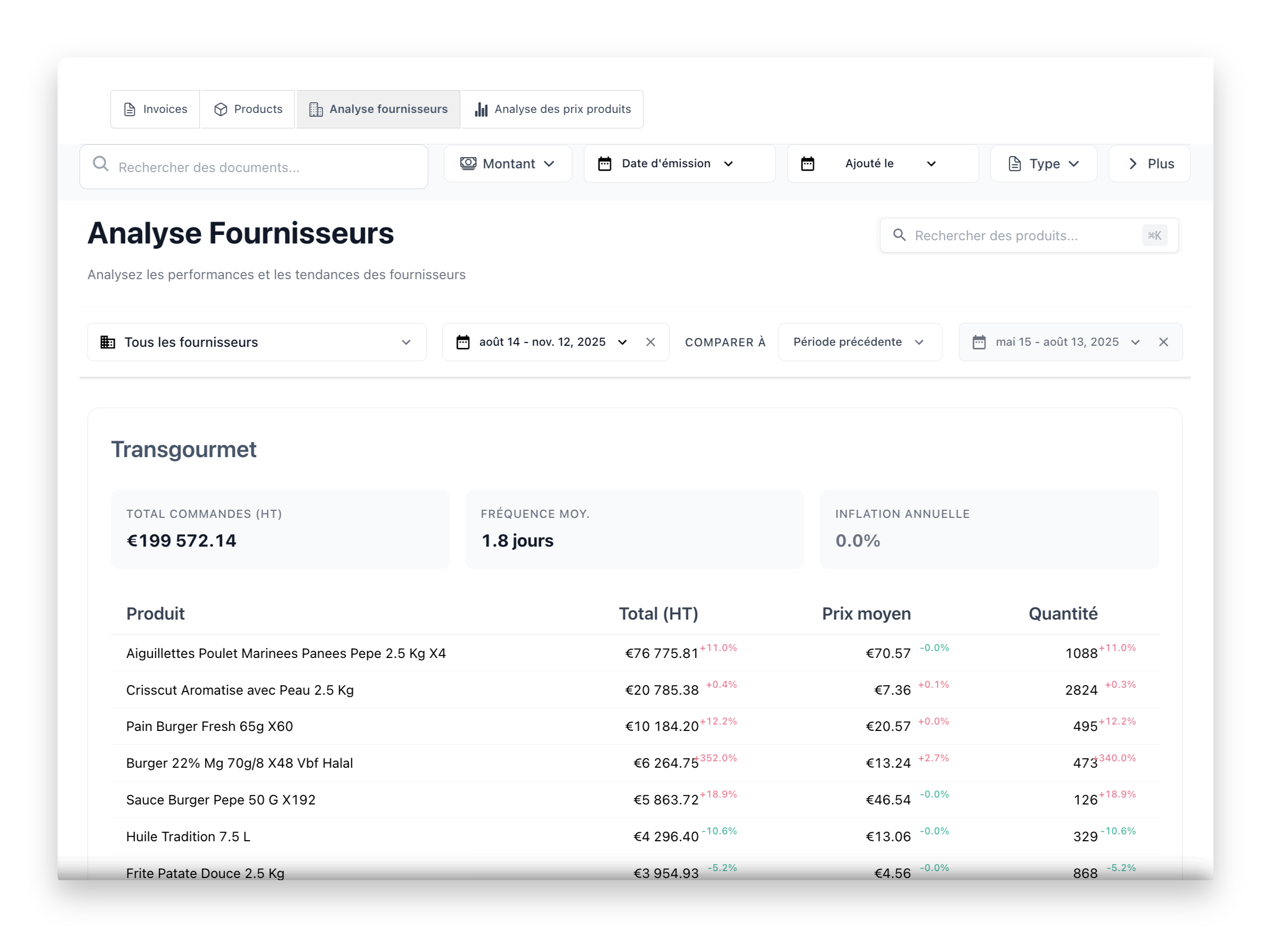

Optimizing Food Costs and Supplier Management

Food costs typically represent 25-35% of restaurant revenue, making it the single largest variable expense. Even small improvements can significantly impact your bottom line and cash flow.

Tracking Food Cost Percentage

Calculate your food cost percentage weekly using this formula:

Food Cost % = (Beginning Inventory + Purchases - Ending Inventory) ÷ Food Sales × 100

Industry benchmarks by restaurant type:

- Fast casual: 25-28%

- Casual dining: 28-32%

- Fine dining: 30-35%

- Pizza/Italian: 24-28%

- Steakhouse: 35-40%

Strategic Supplier Management

Effective supplier management directly impacts your cash flow:

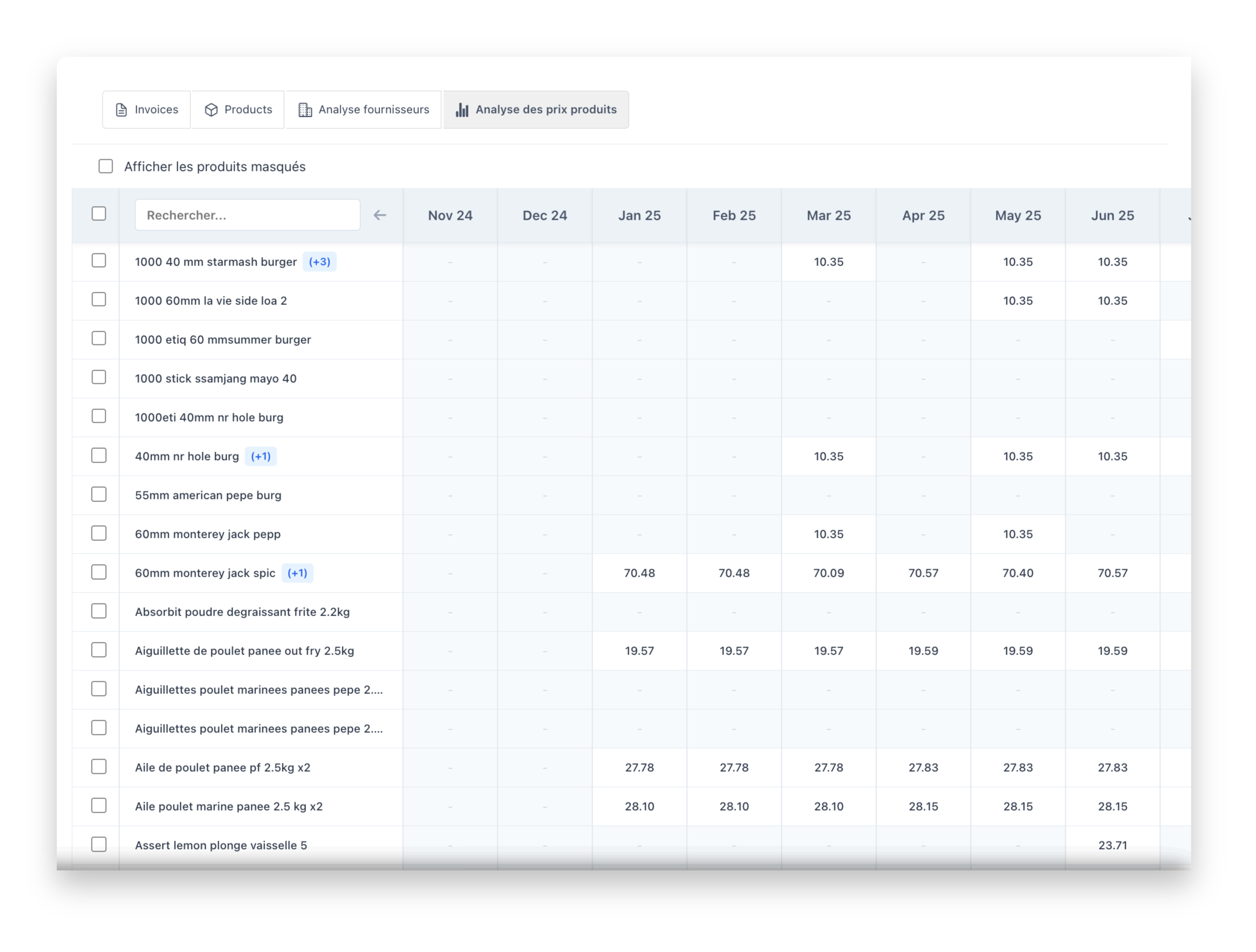

Monitor Price Changes

Suppliers often raise prices gradually—2% here, 5% there. Use supplier analysis tools to:

- Track price changes over time

- Compare pricing across multiple suppliers

- Identify seasonal price patterns

- Catch unauthorized price increases

Negotiate Payment Terms

Payment terms directly affect your cash position:

- COD (Cash on Delivery): Worst for cash flow but sometimes necessary for new accounts

- Net-7: Very short; typical for produce and perishables

- Net-30: Standard terms; gives you time to sell inventory before paying

- Net-45/60: Extended terms for established relationships

- 2/10 Net-30: 2% discount if paid within 10 days; calculate if the discount outweighs cash flow benefit

Reduce Food Waste

The average restaurant wastes 4-10% of purchased food. Reducing waste is pure profit:

- Implement FIFO (First In, First Out) inventory rotation

- Use prep lists based on forecasted covers

- Train staff on portion control and plating standards

- Repurpose trim and scraps creatively (stocks, staff meals, daily specials)

- Track waste daily and hold staff accountable

- Consider composting partnerships that may provide cost offsets

Daily Cash Management Best Practices

Effective daily cash management prevents surprises and keeps operations running smoothly. Implement these routines consistently:

Morning Routine (Before Service)

- Review yesterday's sales vs. forecast and investigate any significant variances

- Check bank accounts and reconcile any outstanding items

- Review and approve any pending supplier payments

- Update the weekly cash flow forecast with actual figures

- Check credit card batch processing from previous night

Evening Routine (After Service)

- Complete cash drawer reconciliation and document any variances

- Prepare bank deposit and minimize overnight cash holdings

- Close out credit card batches promptly

- Review void and comp reports for unusual activity

- Log any equipment issues that may require future expenses

Weekly Routine

- Reconcile all bank accounts and credit card statements

- Review accounts payable aging and prioritize payments

- Calculate and analyze food cost percentage

- Review labor cost percentage against targets

- Update 13-week cash flow forecast

- Pay approved invoices strategically based on terms and cash position

With automated cash flow management tools, many of these tasks can be streamlined or automated, freeing you to focus on running your restaurant.

Cash Flow Forecasting for Restaurants

Accurate cash flow forecasting is essential for making informed business decisions. Here's how to build forecasts at different time horizons:

Short-Term Forecasting (1-4 weeks)

Focus on immediate cash needs:

- Review upcoming bills and payment due dates

- Check reservation books and catering orders for revenue expectations

- Account for known events affecting traffic (local festivals, sports events, weather forecasts)

- Plan for payroll timing (typically the largest single outflow)

- Identify any large one-time expenses

Medium-Term Forecasting (1-6 months)

Plan for seasonal patterns and known changes:

- Apply seasonal adjustment factors from historical data

- Factor in planned menu changes and their cost implications

- Account for scheduled equipment maintenance or replacements

- Plan for quarterly tax payments and annual fees

- Model the impact of any planned promotions or marketing campaigns

Long-Term Forecasting (6-12 months)

Strategic planning horizon:

- Plan for lease renewals and potential rent increases

- Model expansion scenarios and their cash requirements

- Account for inflation in food and labor costs

- Plan for major capital expenditures (renovation, new equipment)

- Set annual profit targets and track progress

Warning Signs of Cash Flow Problems

Catch these warning signs early to prevent cash flow crises. If you notice two or more of these signs, take immediate action:

Early Warning Signs

- Delayed supplier payments - If you're regularly paying invoices late, cash flow is tightening

- Increasing credit utilization - Using credit cards or lines of credit for routine expenses signals insufficient operating cash

- Shrinking cash reserves - If your buffer is declining month over month, investigate why

- Rising food costs - Percentage increasing without menu price adjustments erodes margins

- Declining sales trends - Three consecutive months of declining sales requires immediate attention

Critical Warning Signs

- Payroll concerns - If you're worried about making payroll, you're in crisis mode

- Bounced payments - Any bounced check or failed payment is a serious red flag

- Supplier COD demands - When suppliers move you to COD, your credit reputation is damaged

- Tax payment delays - Unpaid payroll taxes or VAT creates serious legal liability

- Personal funds injection - If you're regularly using personal savings to cover business expenses

If you notice these signs, review your financial performance metrics immediately and consider seeking professional advice from an accountant or restaurant consultant.

Technology Solutions for Restaurant Cash Flow

Modern technology makes cash flow management far easier than manual spreadsheets. The right tools can save hours of administrative work while providing better insights.

Essential Features to Look For

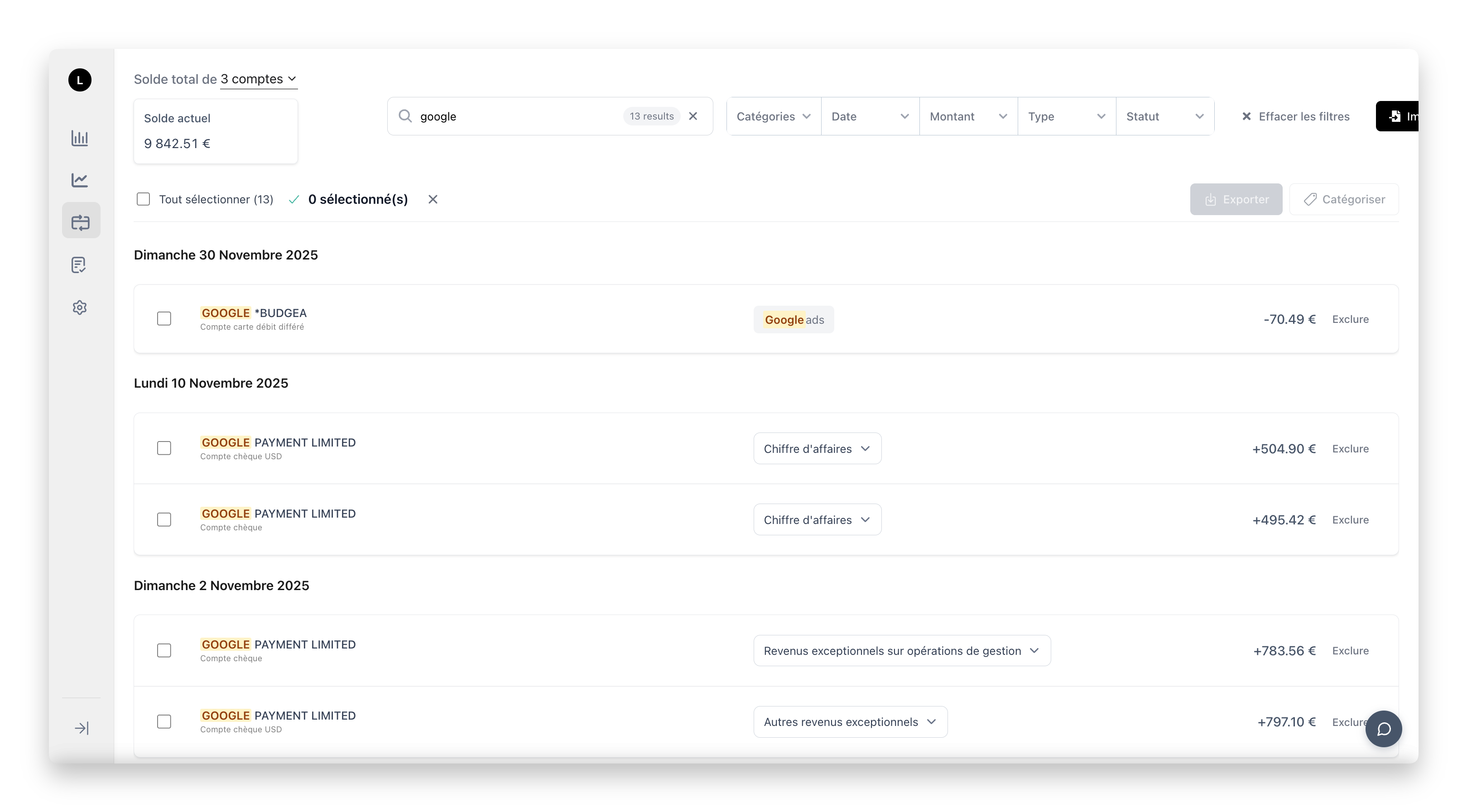

- Bank account synchronization - Real-time visibility into actual cash positions across all accounts

- Automatic transaction categorization - AI-powered sorting saves hours of manual data entry

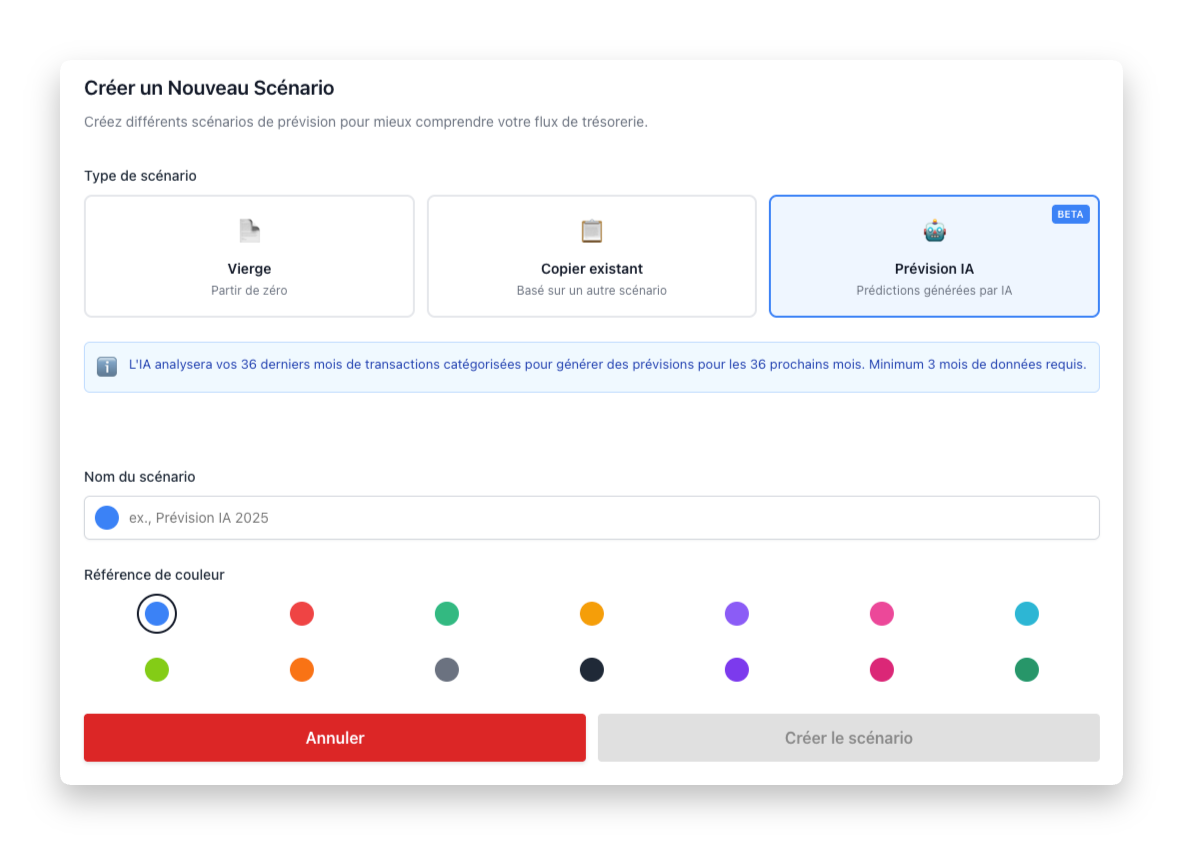

- Cash flow forecasting - Predict future positions based on historical patterns and scheduled payments

- Supplier tracking - Monitor price changes, payment terms, and spending by vendor

- Multi-location support - Consolidated view across all restaurant locations

- Mobile access - Check your cash position from anywhere

- Alert system - Notifications for low balances, unusual transactions, or upcoming cash shortfalls

These tools transform cash flow management from a reactive scramble into proactive planning, giving you the visibility needed to make confident business decisions.

Action Steps for Better Restaurant Cash Flow

Start improving your restaurant's cash flow today with these concrete action steps:

This Week

- Calculate your current break-even point using our free calculator

- Review your last three months of bank statements and categorize all expenses

- Identify your three largest suppliers and review their payment terms

- Calculate your current food cost percentage

This Month

- Implement daily cash reconciliation procedures

- Create a 13-week cash flow forecast

- Negotiate improved payment terms with at least one major supplier

- Identify and eliminate at least three sources of food waste

- Set up a separate savings account for cash reserves

This Quarter

- Build your cash reserve to at least one month of fixed costs

- Implement a cash flow management tool to automate tracking and forecasting

- Review and optimize your menu pricing based on current food costs

- Create a seasonal staffing plan that adjusts labor costs to revenue patterns

- Develop a supplier diversification strategy to reduce dependency and improve negotiating position

Conclusion

Mastering cash flow management won't happen overnight, but consistent attention to these fundamentals will put your restaurant on the path to long-term financial health. The most successful restaurateurs treat cash flow management with the same care and attention they give to their menu and service.

Remember: cash flow problems rarely appear suddenly. They build gradually through small leaks and ignored warning signs. By implementing the practices outlined in this guide and using modern tools to maintain visibility, you can catch problems early and take corrective action before they become crises.

Your restaurant deserves more than survival—it deserves to thrive. Start taking control of your cash flow today.