Understanding the Importance of Financial Audits

Summary

Financial audits ensure transparency, compliance with standards (IFRS/GAAP), and the reliability of financial statements, thereby strengthening stakeholder confidence. Beyond detecting errors and fraud, they improve internal controls, risk management, and inform strategic decision-making. The process follows structured steps (planning, risk assessment, testing, reporting, and follow-up), conducted by internal and/or external auditors, increasingly supported by analytics and automation technologies. Useful in both public and private sectors, audits evolve with AI and cybersecurity and remain essential to sound governance and sustainable growth.

Financial audits play a crucial role in the business world. They ensure transparency and strengthen stakeholder confidence. But why are they so important?

A financial audit is a systematic evaluation of a company's financial statements. It verifies accuracy and compliance with accounting standards. This verification is essential for investors and regulators.

Financial audits are not limited to detecting errors. They also help identify potential fraud. This protects companies and their stakeholders.

Furthermore, financial audits provide valuable information for strategic decision-making. They help executives evaluate their company's financial health. This can influence investment and growth decisions.

Financial audits are also a risk management tool. They help identify weaknesses in internal controls. This helps prevent future problems.

Independence and objectivity are essential in financial audits. Auditors must be impartial to ensure reliable results. This strengthens the credibility of financial reports.

Ultimately, financial audits are indispensable for transparency and trust. They play a key role in corporate governance.

What Is a Financial Audit?

A financial audit evaluates the validity and accuracy of a company's financial statements. These audits are conducted by independent professionals or internal teams. Their primary objective is to ensure that financial information is accurate and compliant with standards.

Financial audits involve several key steps. First, auditors examine the company's accounts. They also analyze accounting policies to verify their adequacy.

Next, auditors perform tests to confirm data integrity. They verify transactions and ensure they are properly recorded. This ensures that financial statements reflect the company's reality.

To clarify, here are the main aspects of a financial audit:

- Verification of financial statement compliance

- Detection of errors and potential fraud

- Evaluation of internal control effectiveness

An audit can be perceived as external validation of financial information. This means that verified statements are more credible to investors. A robust audit can improve market confidence.

In summary, a financial audit does more than validate accounts. It also helps strengthen governance and company reputation. A well-conducted audit is an indispensable asset.

Key Objectives of Financial Audits

Financial audits pursue several essential objectives. One of their main roles is to ensure financial statement compliance. This guarantees that reports comply with current accounting standards.

They also play a crucial role in detecting errors and fraud. A good audit can reveal anomalies requiring immediate attention. Preventing irregularities ensures better financial health for the company.

Additionally, audits contribute to improving internal processes. They identify inefficiencies and propose concrete solutions. This leads to more efficient resource management and cost reduction.

Here are the key objectives of a financial audit:

- Ensure compliance with accounting standards

- Identify potential errors and fraud

- Improve internal processes

- Strengthen investor confidence

- Support informed decision-making

Finally, financial audits strengthen the confidence of investors and other stakeholders. Audited reports provide a clear view of the financial situation. This allows decision-makers to make strategic decisions based on reliable data.

Internal Audit vs. External Audit: Understanding the Differences

Internal and external audits are two distinct types of financial examination. Each has its own objective and scope. Understanding their differences is crucial for effective management.

An internal audit is typically conducted by a dedicated department within the company. Its purpose is to evaluate internal controls and improve processes. Internal auditors help identify and manage risks.

In contrast, an external audit is conducted by an independent party, often an accounting firm. Its main objective is to provide an impartial opinion on financial statements. This helps strengthen the confidence of external parties such as investors.

The main differences include:

- Objective: Internal improvement vs. External verification

- Independence: Internal to employees vs. External to the firm

- Target audience: Internal management vs. External stakeholders

- Frequency: Can be continuous vs. Often annual

- Standards used: Vary according to internal needs vs. International accounting standards

Another important aspect is audit frequency. Internal audits can occur regularly throughout the year. Conversely, external audits tend to be annual.

Each type of audit offers specific and complementary advantages. Used in tandem, they can greatly improve a company's efficiency and transparency.

The Financial Audit Process: Step by Step

The financial audit process is a well-defined series of steps. Each is crucial to achieving a complete and accurate audit. Let's look at these key steps more closely.

1. Audit Planning

The audit begins with a planning phase. Auditors gather information about the company and establish a timeline. They also set specific audit objectives.

2. Risk Assessment

During this step, auditors identify and assess potential risks. This includes fraud and potential errors. A correct assessment helps focus efforts on high-risk areas.

3. Internal Control Analysis

Next, auditors examine the internal controls in place. They verify whether these controls are sufficient to prevent errors and fraud. They also test the effectiveness of these controls as needed.

- Documentation of existing internal controls

- Evaluation of control effectiveness

- Identification of potential weaknesses

4. Evidence Collection

This phase involves collecting evidence to support findings. Auditors examine financial statements and other relevant documents. They also perform independent verifications.

5. Analysis and Evaluation

The information collected is then analyzed and evaluated. Auditors determine the accuracy of financial statements. They also identify areas requiring improvement.

- Financial statement review

- Inconsistency identification

- Improvement recommendations

6. Audit Report

Results are compiled in a final audit report. This document presents conclusions and recommendations. It is crucial for managers and stakeholders.

7. Communication to Stakeholders

The report is then communicated to relevant stakeholders. This communication helps improve strategic decisions. It also strengthens investor confidence.

8. Follow-up and Continuous Improvement

Finally, follow-up on audit recommendations is essential. Companies must ensure they improve identified processes. This ensures more efficient and secure management in the long term.

Regulatory Standards and Compliance in Financial Auditing

Regulatory standards are essential in financial auditing. They ensure consistency and credibility of audits performed. Auditors must follow these standards to ensure accuracy.

Two main frameworks guide audits. These are International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP). Each framework provides specific guidelines for preparing financial statements.

Compliance with these standards is crucial to avoid penalties. Companies must ensure their audits comply with all applicable laws. A lack of compliance can seriously damage reputation.

- IFRS (International Financial Reporting Standards)

- GAAP (Generally Accepted Accounting Principles)

- National financial legislation

Auditors play a key role in ensuring company compliance. They must stay informed of legislative changes. This ensures that audits are always relevant and reliable.

The Role of Financial Audits in Risk Management

Financial audits play a central role in risk management. They identify and assess potential financial risks. This allows companies to anticipate and mitigate problems before they occur.

Through audits, companies gain a clear view of their weaknesses. This proactive approach reduces the chances of financial loss. A thorough audit can flag anomalies or fraud threatening financial stability.

Auditors evaluate internal processes to ensure their effectiveness. Strong internal control is essential to minimize risks. The audit verifies the consistency and integrity of these processes.

- Risk identification

- Internal control evaluation

- Fraud prevention

- Financial loss mitigation

Thus, financial audits strengthen investor confidence. A well-conducted audit reassures stakeholders about prudent risk management. It also ensures the company is well prepared for the future.

How Financial Audits Enhance Transparency and Stakeholder Trust

Financial audits are crucial for ensuring company transparency. By thoroughly analyzing financial statements, auditors provide an accurate picture of the economic situation. This feeds stakeholder confidence.

The integrity of financial audits rests on rigorous standards. By following these standards, companies ensure the accuracy of their financial statements. This truthfulness strengthens credibility with investors and partners.

Clear communication of audit results is essential. Results must be shared transparently with all stakeholders. This transparency avoids misunderstandings and strengthens trust.

- Financial accuracy verification

- Credibility strengthening

- Clear communication of results

- Improved investor relations

Finally, regular audits demonstrate a company's commitment to compliance and honesty. This reassures investors about ethical company management. Thus, auditing becomes an essential tool for long-term success.

The Impact of Financial Audits on Strategic Decision-Making

Financial audits play a key role in strategic decision-making. With accurate data, executives can assess their company's financial health. This is fundamental to guiding future initiatives.

Rigorous financial analysis highlights strengths and weaknesses. This helps identify areas requiring improvement or increased attention. With a clear view of these aspects, companies can better allocate their resources.

Strategic decisions based on audits tend to be more informed. This reduces the risk of costly errors. Audits provide a solid foundation for informed choices.

- Evaluation of financial strengths and weaknesses

- Better resource allocation

- Strategic risk reduction

Finally, the transparency offered by audits reassures shareholders. This paves the way for investments and constant support. Thus, governance is strengthened and long-term objectives are achieved.

Preparing for a Financial Audit: Best Practices

Adequate preparation for a financial audit is crucial. Rigorous planning ensures a smooth process. This minimizes the risk of errors and delays.

Start by organizing all your financial documents. This includes bank statements, invoices, and accounting books. The clarity and accuracy of these records are essential.

It's also important to understand the specific audit requirements. Discuss with your auditors to stay current on standards. This will help align your practices with expectations.

Training your team on audit practices can also be beneficial. Ensure they understand their roles and responsibilities. A well-prepared team can facilitate a smooth transition.

- Organize and update financial documents

- Understand audit standards and requirements

- Train the team on audit practices and processes

In summary, preparation is the key to audit success. It promotes transparency and strengthens stakeholder confidence. Thus, the company positions itself for stable future growth.

Tools and Technologies in Modern Financial Auditing

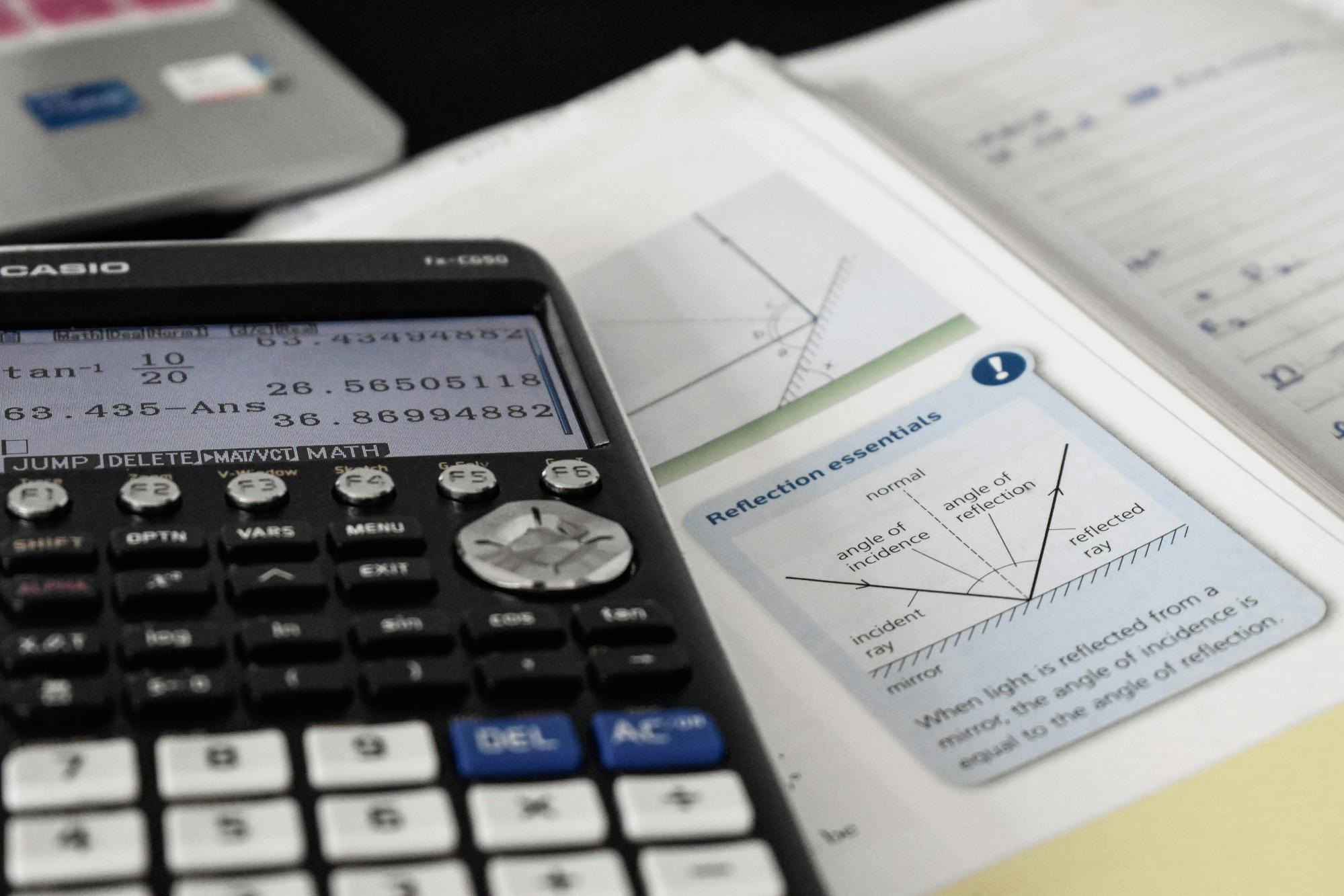

Technological evolution is transforming financial audit practices. Today, auditors use sophisticated tools. These technologies improve accuracy and efficiency.

Data analytics software plays a key role. It enables rapid analysis of large quantities of data. This helps identify trends and anomalies.

Automation is becoming essential in the field. It reduces human errors and accelerates processes. Auditors can thus devote more time to strategic analysis.

- Data analytics software

- Repetitive task automation tools

- Online collaboration platforms

Additionally, collaboration platforms facilitate teamwork. They enable real-time information exchange. This ensures all team members stay informed.

Common Challenges and How to Overcome Them

Financial audits present many complex challenges. One is managing large data volumes. This requires careful sorting to avoid errors.

Another difficulty lies in regulatory standards. These regulations are often complex and constantly evolving. Staying current is essential to ensure compliance.

Communication is also a key challenge. Auditors must effectively convey their results to stakeholders. Poor communication can lead to misunderstandings.

- Managing large quantities of data

- Understanding regulatory standards

- Clear communication of results

Finally, human biases can influence audits. Auditors must be aware of these biases. Continuous training and self-assessment help overcome them.

Case Studies: Successful Financial Audits and Their Impact

Successful financial audits provide valuable lessons. A notable example is that of a large technology company. It discovered inefficiencies through a thorough audit.

This company was able to save millions by optimizing its processes. This also strengthened investor confidence. Positive results boosted its stock value.

In another case, a service company avoided a crisis thanks to an audit. The audit revealed weaknesses in risk management. By correcting these flaws, the company preserved its reputation.

- Process optimization

- Strengthened investor confidence

- Reputation preservation

These case studies show the importance of financial audits. Not only do they detect problems, but they also help solve them. Companies can thus improve their overall performance.

The Evolving Role of the Financial Auditor

The role of the financial auditor has transformed considerably. Previously, auditors were primarily number verifiers. Today, they are strategic advisors.

Digital technologies are transforming audit practices. Auditors now use advanced software to detect anomalies. This enables deeper and faster analysis of financial data.

Moreover, auditors are now involved in risk management. They help companies identify and mitigate potential threats. Thus, their role goes beyond simple accounting control.

- Use of advanced software

- Strategic advice

- Risk management

Ultimately, auditors must constantly train. The emergence of new technologies and practices requires it. Thus, they remain at the forefront of their sector and relevant to their clients.

Financial Audits in Different Sectors: Public vs. Private

Financial audits vary between public and private sectors. In the public sector, transparency and compliance are essential. These audits ensure that public funds are used correctly.

In the private sector, the focus is on profit maximization. Audits aim to ensure financial statement accuracy. This helps attract investors and maintain trust.

Audit standards may differ between these sectors. Public agencies often follow government-specific regulations. Private companies comply with industry standards like IFRS or GAAP.

- Transparency and compliance for the public sector

- Profit maximization for the private sector

- Differences in standards and regulations

In summary, each sector has its own challenges and expectations. Auditors must adapt their approach according to context. This ensures audits provide value regardless of sector.

The Future of Financial Auditing: Trends and Innovations

Financial auditing is evolving with technological innovations. Automation is transforming how audits are conducted. Data analytics software is increasingly used.

Auditors must adapt to new technologies. Artificial intelligence helps identify anomalies in accounting data. This improves audit accuracy and efficiency.

Cybersecurity has become a major concern. Audits now include IT security assessments. This ensures the protection of financial information.

- Automation and data analytics software

- Use of artificial intelligence

- Increased importance of cybersecurity

Auditors must also continuously train. Digital technology skills are becoming essential. This enables better adaptation to future audit needs.

Conclusion: Why Financial Audits Matter More Than Ever

Financial audits are essential in the modern business world. They strengthen transparency and trust among stakeholders. This is indispensable for effective management.

With the evolution of technologies and regulations, the importance of audits only increases. They help companies adapt and thrive in a constantly changing environment. Auditors play a key role in this process.

For companies, neglecting financial audits can lead to serious consequences. This includes financial errors, lack of investor confidence, and compliance problems. By investing in rigorous audits, companies ensure a prosperous future.

- Strengthened transparency

- Adaptation to technological evolutions

- Prevention of financial errors