5 Cash Management Trends for 2026

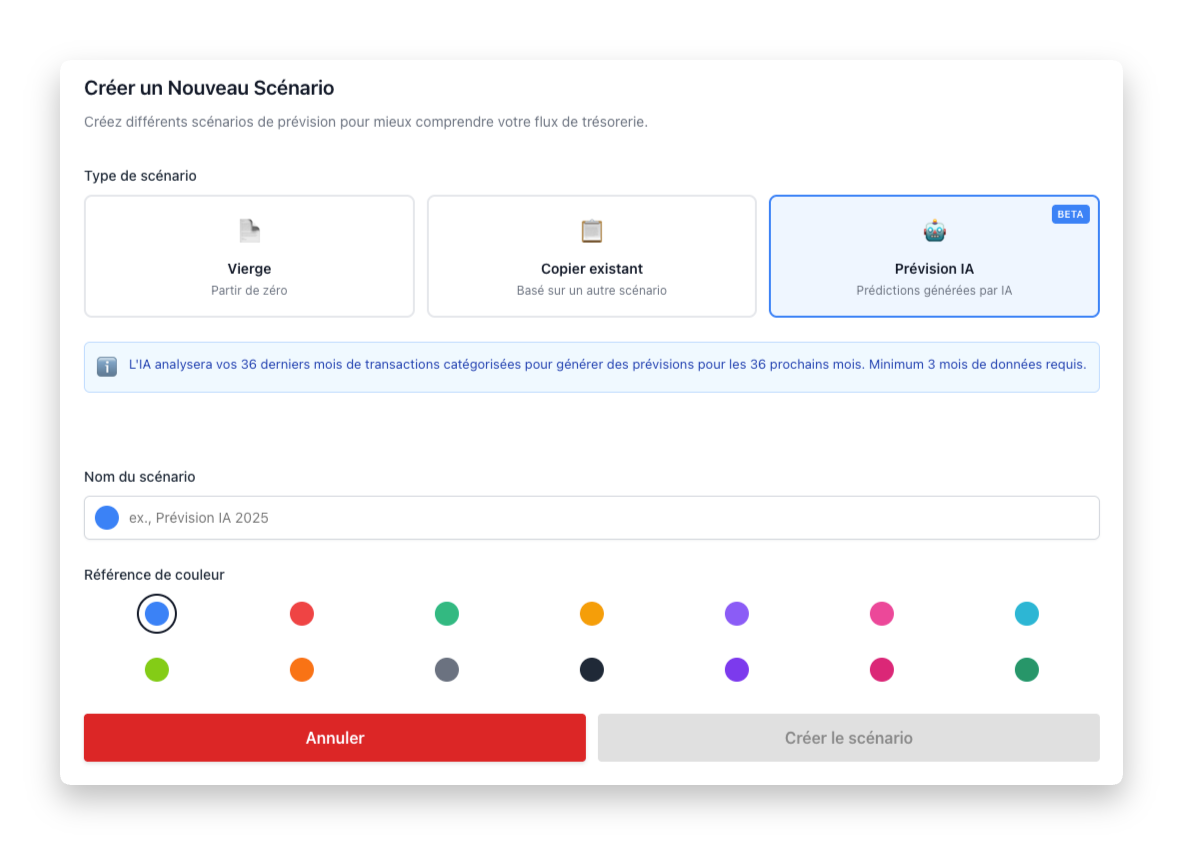

1. Generative AI Revolutionizes Treasury

Generative AI goes beyond traditional forecasting. It analyzes, recommends, and automates financial decisions.

What Changes in 2026

Generative AI tools can now:

- Write financial reports automatically

- Suggest actions based on your cash position

- Answer your questions in natural language

- Detect anomalies before they become problems

Real Examples

Conversational analysis: Ask "What's my cash risk this month?" and get a detailed answer.

Proactive recommendations: AI alerts you: "Delay this supplier payment by 5 days to optimize your cash."

Key takeaway: Generative AI transforms the treasurer into a strategist. Repetitive tasks disappear.

2. Open Banking 2.0: Total Connection

Open Banking is evolving. In 2026, connections between banks, suppliers, and customers become seamless.

What's New

- Integrated payments: Pay directly from your management software

- Enriched data: More accurate automatic categorization

- Simplified multi-bank: One view for all your accounts

Impact for SMBs

No more CSV exports and manual reconciliations. Everything syncs in real time.

Key stat: 80% of European SMBs will use Open Banking by end of 2026.

Tip: Choose Open Banking compatible tools now.

3. Sustainable Finance and ESG Criteria

Sustainability is no longer optional. ESG criteria (Environmental, Social, Governance) now impact treasury.

Why It Matters

- Access to financing: Banks favor sustainable businesses

- Preferential rates: Up to 0.5% reduction for green loans

- Brand image: Customers prefer responsible companies

Concrete Actions

- Measure your carbon footprint related to financial flows

- Prioritize local suppliers to reduce costs and impact

- Document your ESG actions for financing requests

Trend: Green bonds and sustainable financing are growing 30% annually.

4. Total Payment Automation

In 2026, manual payments become the exception. Automation covers the entire cycle.

What Gets Automated

- Incoming invoices: OCR reading, validation, automatic payment

- Customer reminders: Personalized sequences based on profile

- Reconciliation: Automatic invoice/payment matching

- Reporting: Dashboards generated in real time

Concrete Gains

Time: 5 hours saved per week on average

Errors: 90% reduction in data entry errors

Delays: Payments received 10 days earlier on average

Tip: Start by automating customer reminders. It's the quickest win.

5. Real-Time Risk Management

Crises are unpredictable. In 2026, risk management becomes proactive and continuous.

New Tools

- Automatic stress tests: Simulate crisis scenarios in one click

- Smart alerts: Notification before problems, not after

- Supplier scoring: Assess your partners' default risk

Scenarios to Test

- What happens if my biggest client pays 60 days late?

- What's the impact if my costs increase by 15%?

- How long can I survive without new revenue?

Stat: Companies doing regular stress tests have 40% fewer cash crises.

Summary: Your Priorities for 2026

The five trends to adopt:

- Generative AI: Move from analysis to automated action

- Open Banking 2.0: Connect all your financial flows

- Sustainable finance: Integrate ESG criteria into your strategy

- Automation: Eliminate repetitive manual tasks

- Risk management: Anticipate crises before they happen

Immediate action: Assess where you stand on each trend. Identify one priority for Q1 2026.

Businesses that adopt these trends will gain a competitive advantage.