Manufacturing Cash Flow Guide 2026

Why Cash Flow is Critical for Manufacturers

Manufacturing businesses face uniquely complex cash flow challenges due to the nature of production cycles, capital intensity, and supply chain dynamics. According to Make UK's 2024 Executive Survey, 67% of manufacturers cite working capital as a key concern, making it the most commonly cited financial challenge in the sector.

The fundamental cash flow challenge in manufacturing is simple: you must purchase raw materials, pay workers, and run production equipment before you can sell finished goods—and then wait further for customers to pay. This creates a substantial working capital requirement that must be carefully managed.

- Raw material investment—materials purchased weeks or months before finished goods are sold; UK manufacturers hold average 45-60 days of material inventory

- Long production cycles—cash tied up in work-in-progress for days, weeks, or months depending on product complexity

- Customer payment terms—B2B customers often demand 60-90 day terms; automotive OEMs may demand 120 days

- Capital equipment costs—significant ongoing investment in machinery, tooling, and maintenance

- Energy costs—UK manufacturers saw energy costs rise 150% between 2021-2024; often 5-15% of revenue

- Supply chain volatility—material prices, lead times, and availability fluctuate; requires buffer stock

- Seasonal demand patterns—many sectors have pronounced seasonality affecting production scheduling and cash flow

- Quality costs—scrap, rework, and warranty claims impact cash flow unpredictably

Research by Siemens Financial Services found that UK manufacturers have an estimated £500 billion tied up in working capital across the sector. Companies that optimise their cash conversion cycle can release substantial funds for investment or resilience.

In manufacturing, cash is oxygen. You can have full order books, state-of-the-art equipment, and excellent products, but run out of cash and production stops. I've seen profitable manufacturers go under because they couldn't bridge the gap between paying suppliers and collecting from customers. — UK Manufacturing Director

Understanding the Manufacturing Cash Conversion Cycle

The cash conversion cycle (CCC) is the key metric for understanding manufacturing cash flow. It measures how long cash is tied up in operations from purchasing materials to receiving payment for finished goods:

CCC = Days Inventory Outstanding (DIO) + Days Sales Outstanding (DSO) - Days Payables Outstanding (DPO)

Understanding each component:

- Days Inventory Outstanding (DIO): How long materials and products sit in inventory before being sold

- Days Sales Outstanding (DSO): How long customers take to pay after invoicing

- Days Payables Outstanding (DPO): How long you take to pay your suppliers

UK Manufacturing Benchmarks by Sector

Cash conversion cycles vary significantly by manufacturing sector:

General Engineering

- DIO: 45-60 days

- DSO: 50-65 days

- DPO: 45-55 days

- Typical CCC: 50-70 days

Food and Beverage

- DIO: 20-35 days (perishable goods)

- DSO: 40-55 days

- DPO: 35-50 days

- Typical CCC: 25-40 days

Aerospace and Defence

- DIO: 90-150 days (complex, long-cycle production)

- DSO: 60-90 days

- DPO: 50-70 days

- Typical CCC: 100-170 days

Automotive Components

- DIO: 30-50 days (JIT requirements)

- DSO: 75-120 days (OEM payment terms)

- DPO: 45-60 days

- Typical CCC: 60-110 days

Cash Inflows for Manufacturers

- Product sales: Finished goods sold to customers; main revenue source

- Progress payments: For large or custom orders; staged payments during production

- Advance payments: Deposits on confirmed orders; excellent for cash flow

- Scrap sales: Metal scrap, recyclables, off-cuts; often overlooked revenue

- Tooling charges: Customer-specific tooling costs passed through

- NRE (Non-Recurring Engineering): Design and development charges for custom products

- Spare parts: Often higher margin than original equipment

Cash Outflows for Manufacturers

Direct Costs (typically 60-75% of revenue)

- Raw materials: 35-50% of revenue; largest single cost category

- Direct labour: 15-25% of revenue; wages for production workers

- Outsourced processes: 5-15% of revenue (plating, coating, heat treatment, etc.)

- Packaging and shipping: 3-8% of revenue; varies with product and destination

- Energy (production): 3-8% of revenue; highly variable by sector and process

Overhead Costs (typically 20-30% of revenue)

- Indirect labour and supervision: Quality, planning, maintenance staff

- Facility costs: Rent/mortgage, rates, utilities, insurance

- Equipment maintenance: Preventive maintenance, repairs, spare parts

- Depreciation: Non-cash but represents ongoing capital investment need

- Administration and sales: Office staff, sales team, marketing

- Quality and compliance: Testing, certification, audits

Managing Inventory for Cash Flow

Inventory represents the largest cash outlay for most manufacturers. Every pound tied up in stock is a pound not available for other uses. Effective inventory management is the single biggest lever for improving manufacturing cash flow.

Types of Inventory

- Raw materials: Purchased inputs awaiting production; metals, plastics, components

- Work-in-progress (WIP): Partially completed products on the shop floor

- Finished goods: Completed products awaiting sale or dispatch

- Consumables: Production supplies, tooling consumables, packaging

- Spare parts: Maintenance spares for equipment

Inventory Valuation Methods

Understanding how inventory is valued affects financial reporting and cash flow analysis:

- FIFO (First-In-First-Out): Oldest stock used first; common in UK

- Weighted average: Average cost of all stock; simpler to administer

- Standard cost: Predetermined costs; requires variance analysis

Inventory Optimisation Strategies

- Just-in-time (JIT): Reduce raw material holding where supply chains allow; requires reliable suppliers

- ABC analysis: Classify inventory by value and focus management attention on high-value A items

- Safety stock optimisation: Balance service levels (avoiding stockouts) against cash tied up in buffer stock

- Vendor-managed inventory (VMI): Supplier holds stock until used; shifts cash requirement to supplier

- Consignment stock: Don't pay until you use it; preserves cash but requires trust

- Economic order quantity (EOQ): Calculate optimal order sizes balancing ordering costs and holding costs

- Kanban systems: Pull-based replenishment reduces WIP and finished goods inventory

Managing Work-in-Progress (WIP)

WIP is often the hidden cash trap in manufacturing:

- Reduce batch sizes: Smaller batches mean less WIP; implement lean manufacturing principles

- Improve flow: Identify and remove bottlenecks that cause WIP to accumulate

- Reduce lead times: Shorter production cycles mean less cash tied up in process

- Track WIP value: Know exactly how much cash is on the shop floor at any time

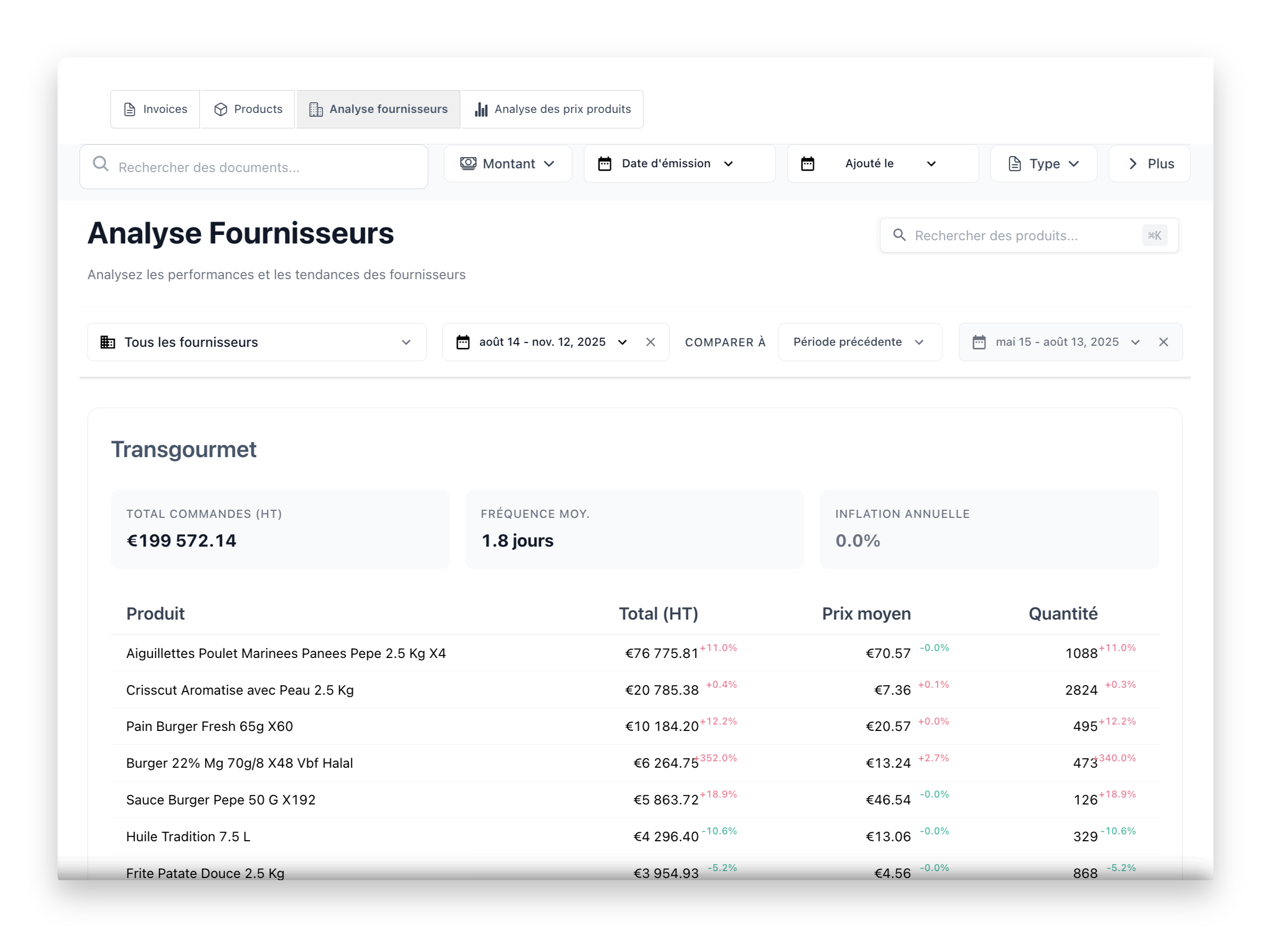

Managing Supplier Payments

How you manage supplier payments directly impacts your cash conversion cycle. The goal is to optimise payment timing while maintaining strong supplier relationships.

Negotiating Payment Terms

- Standard terms: Net-30 to Net-60 most common in UK manufacturing

- Extended terms: Net-90 or longer for strategic suppliers; requires strong relationship

- Early payment discounts: 2/10 Net-30 means 2% discount for paying within 10 days (36% annualised return)

- Staged payments: For large orders—deposit, progress payments, final payment on delivery

- Consignment terms: Pay only when material is consumed; best for high-volume items

Supplier Payment Strategies

- Segment suppliers: Different strategies for strategic vs commodity suppliers

- Consolidate spend: Greater volumes enable better terms negotiation

- Long-term agreements: Commit volume in exchange for better terms and price stability

- Reverse factoring: Your bank pays supplier early; you pay bank later

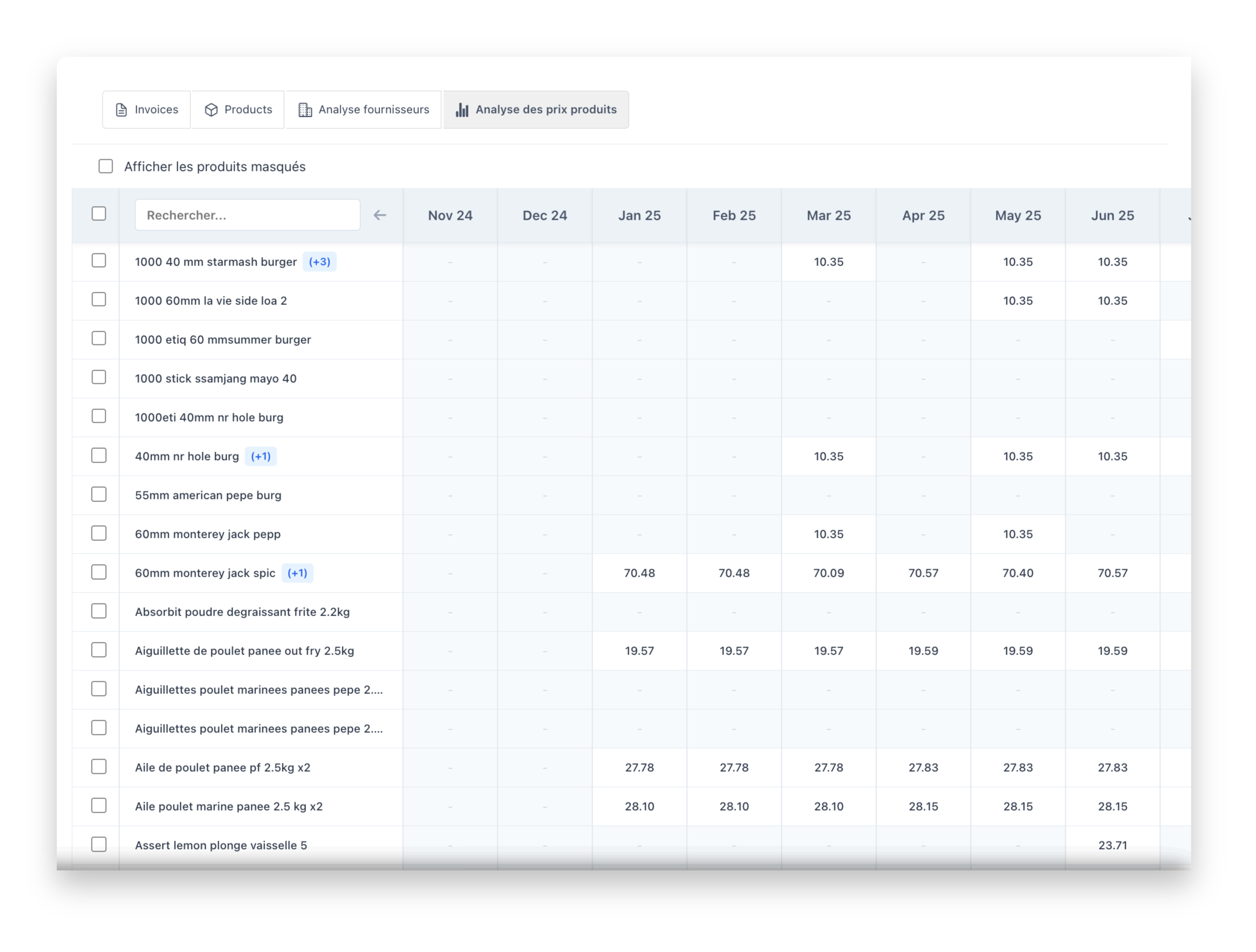

Material Price Volatility Management

UK manufacturers face significant material price fluctuations:

- Steel: Prices varied 40%+ in 2024 alone; consider stockholder contracts

- Aluminium: Subject to LME price movements; consider fixed-price agreements

- Plastics: Linked to oil prices; monitor feedstock markets

- Copper: Significant price swings; consider forward contracts

Price Volatility Strategies

- Index-linked pricing: Customer prices adjust with material costs (pass-through)

- Forward buying: Purchase material ahead when prices are favorable

- Hedging: Financial instruments to lock in future prices (for commodities)

- Multiple sourcing: Reduce dependency on single supplier or region

- Cost-plus contracts: Price to customers includes material cost component

Optimising Customer Receivables

Getting paid faster is as important as managing costs. Every day shaved off DSO releases cash for the business.

UK Manufacturing Payment Terms by Customer Type

- SME customers: 30 days; usually pay reasonably promptly

- Mid-market corporates: 45-60 days; more process but manageable

- Large corporates: 60-90 days; procurement department dictates terms

- Automotive OEMs: Often 90-120 days; challenging but often high volume

- Public sector: 30 days contractual; often slower in practice

- Export customers: Varies by country; consider letters of credit

Improving Collection

- Invoice promptly: Same day as dispatch where possible; don't wait for month end

- Electronic invoicing: Faster processing, faster payment; many large customers require EDI

- Credit management: Check customer creditworthiness before accepting orders; set credit limits

- Proactive collection: Start follow-up before invoice is due; call 7 days ahead of due date

- Direct debit: Where possible, set up automatic payment for regular customers

- Multiple payment options: Make it easy to pay; offer card, BACS, faster payments

Invoice Factoring and Financing

- Invoice factoring: Advance 70-85% of invoice value immediately; factor collects payment

- Invoice discounting: Similar advance but you manage collection; more confidential

- Selective invoice finance: Finance specific large invoices only; more flexible

- Supply chain finance: Customer's bank pays you early; customer pays bank later

Capital Equipment and Cash Flow

Manufacturing requires significant ongoing capital investment. How you finance equipment directly impacts cash flow.

Equipment Financing Options

- Outright purchase: Large upfront outflow but no ongoing payments; best when cash is available

- Hire purchase: Spread cost; own equipment at end of term; interest costs but preserves cash

- Finance lease: Similar to HP but tax treatment may differ; consider with accountant

- Operating lease: Lower monthly payments; return equipment at end; no ownership

- Sale and leaseback: Release cash from existing equipment; ongoing lease payments

Capital Allowances and Tax Relief

UK tax reliefs significantly impact equipment investment cash flow:

- Annual Investment Allowance (AIA): 100% tax relief on first £1M capital spend per year

- Full Expensing: 100% relief on qualifying plant and machinery from April 2023

- R&D Tax Credits: 25-33% relief on qualifying development and innovation costs

- Writing down allowances: 18% (main pool) or 6% (special rate) for items not covered by above

Maintenance and Repair Cash Flow

- Preventive maintenance budgeting: Plan and budget for routine maintenance costs

- Breakdown contingency: Reserve for unexpected repairs; equipment failures are inevitable

- Service contracts: Spread maintenance costs; predictable monthly/annual payments

- Spare parts strategy: Balance holding critical spares against cash tied up

Energy Cost Management

Energy costs have become a major cash flow factor for UK manufacturers:

Energy Cost Strategies

- Fixed-price contracts: Lock in rates for budget certainty

- Energy efficiency: Investment in efficient equipment reduces ongoing costs

- Off-peak production: Shift energy-intensive processes to cheaper tariff periods

- On-site generation: Solar, CHP plants; capital investment but long-term savings

- Government support: Check eligibility for energy-intensive industry relief

Warning Signs of Cash Flow Problems

Watch for these red flags:

- Increasing CCC: Cash conversion cycle lengthening month over month

- Supplier pressure: Key suppliers asking for faster payment or reducing credit

- Customer stretching: Customers taking longer to pay than agreed

- Inventory building: Stock levels rising without corresponding orders

- Delaying payments: Having to choose which suppliers to pay

- Overdraft reliance: Permanently at or near overdraft limit

- Declining orders: Order book shrinking while fixed costs remain

- HMRC arrears: Falling behind on PAYE, NI, or VAT

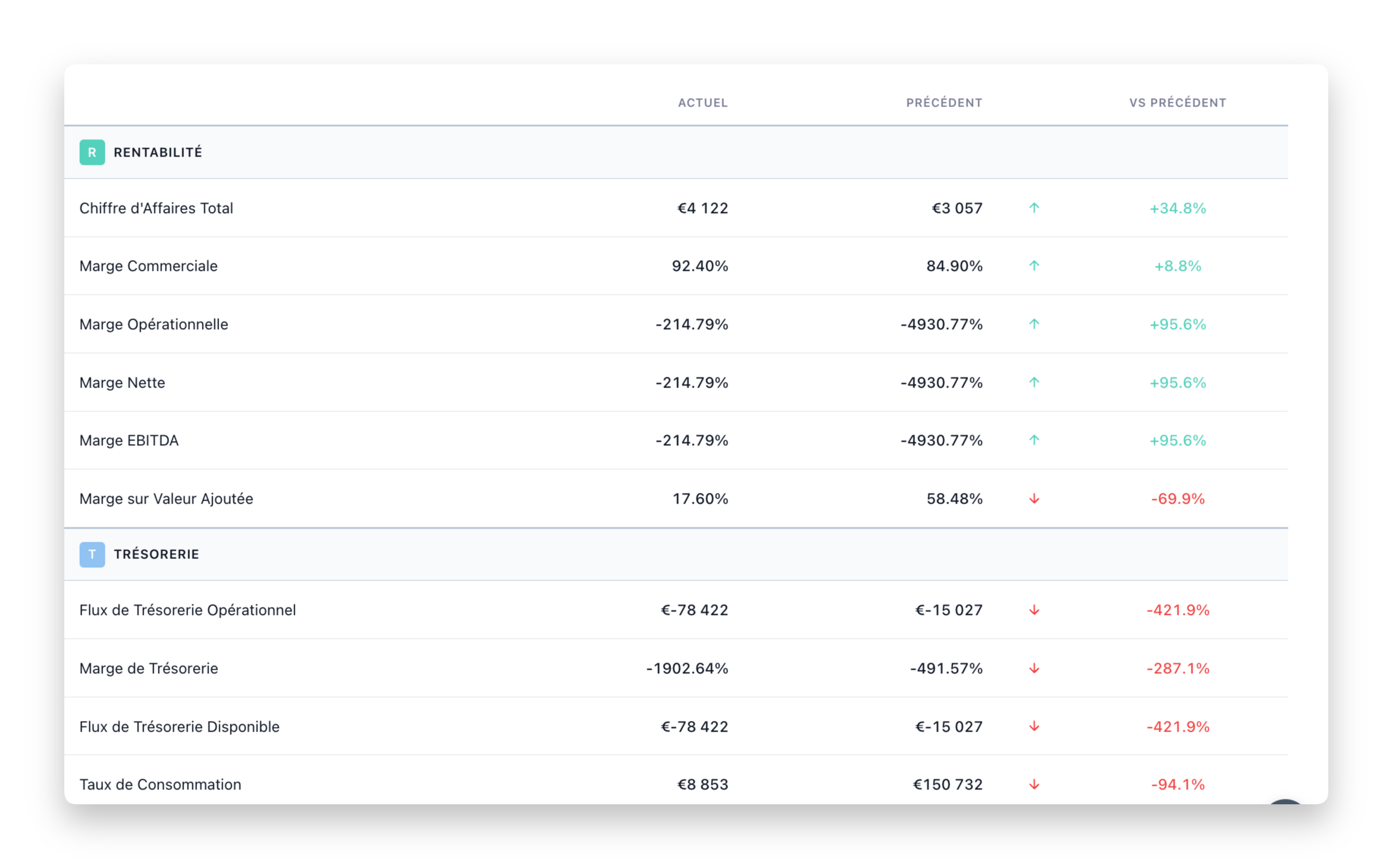

Key Manufacturing Cash Flow Metrics

Track these metrics regularly (weekly or monthly):

- Cash conversion cycle: Target reduction year-on-year; benchmark against sector

- Days inventory outstanding: By category (raw, WIP, finished); identify where cash is stuck

- Days sales outstanding: Target under 50 days; track by customer

- Days payables outstanding: Optimise without damaging supplier relationships

- Inventory turnover: Times per year stock is sold; higher is generally better

- Working capital ratio: Current assets ÷ current liabilities (target: 1.5-2.0)

- Quick ratio: (Current assets - inventory) ÷ current liabilities (target: above 1.0)

- Cash runway: Months of fixed costs covered by cash reserves (target: 2-3 months)

Action Steps for Better Manufacturing Cash Flow

This Week

- Calculate your current cash conversion cycle by component (DIO, DSO, DPO)

- Review inventory levels by category—identify slow-moving and excess stock

- Identify your top 10 customers by outstanding receivables—chase overdue amounts

- Review your current payment terms with top 5 suppliers

- Check your energy contract end dates and current rates

This Month

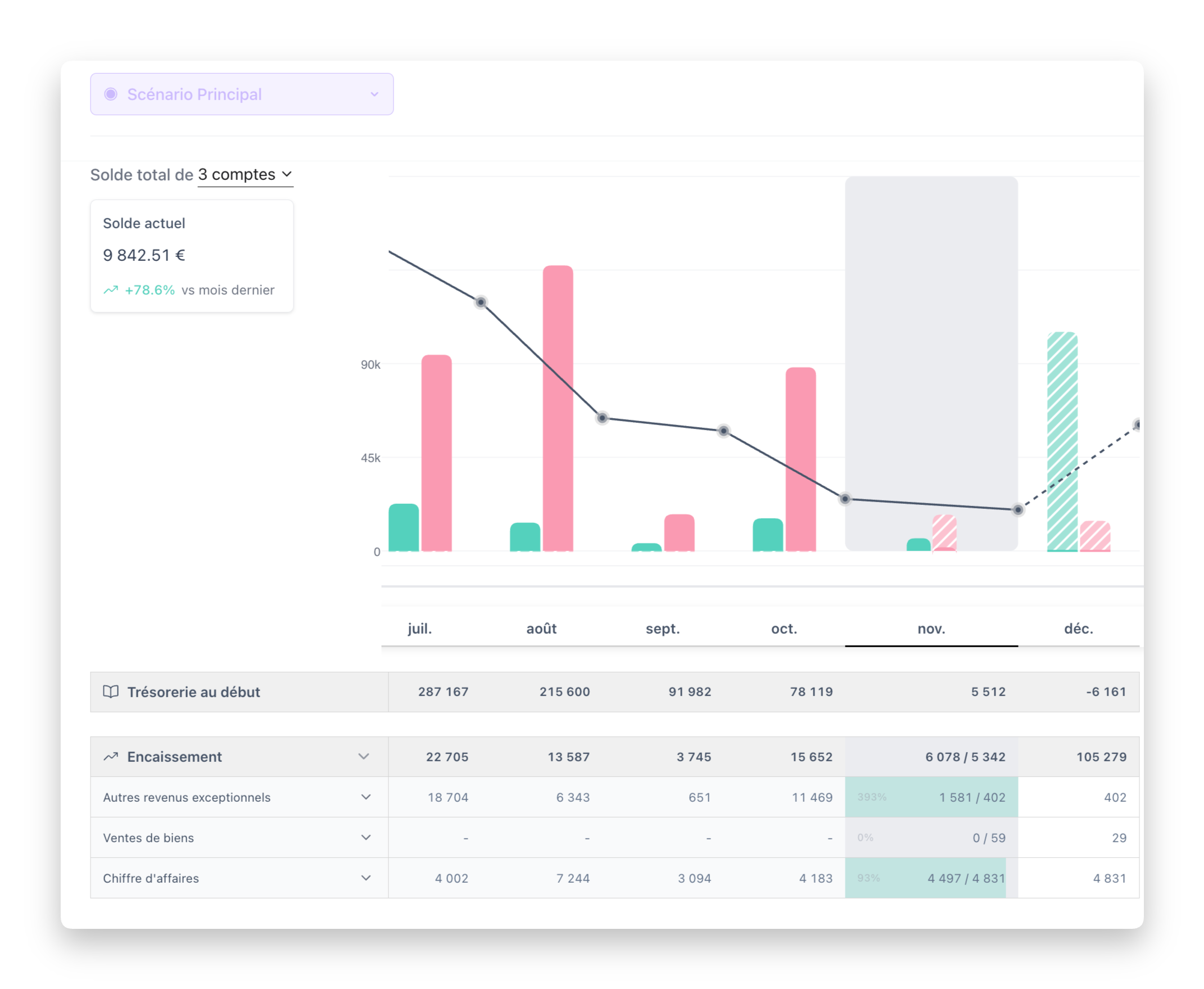

- Implement weekly cash flow forecasting linked to production schedule

- Negotiate improved terms with at least 3 major suppliers

- Review and take action on slow-moving inventory—sell, discount, or scrap

- Set up automated payment reminders for customers at 7 and 14 days pre-due

- Review equipment financing options for any planned capital purchases

This Quarter

- Target 10% reduction in cash conversion cycle

- Build 2-month cash reserve (minimum)

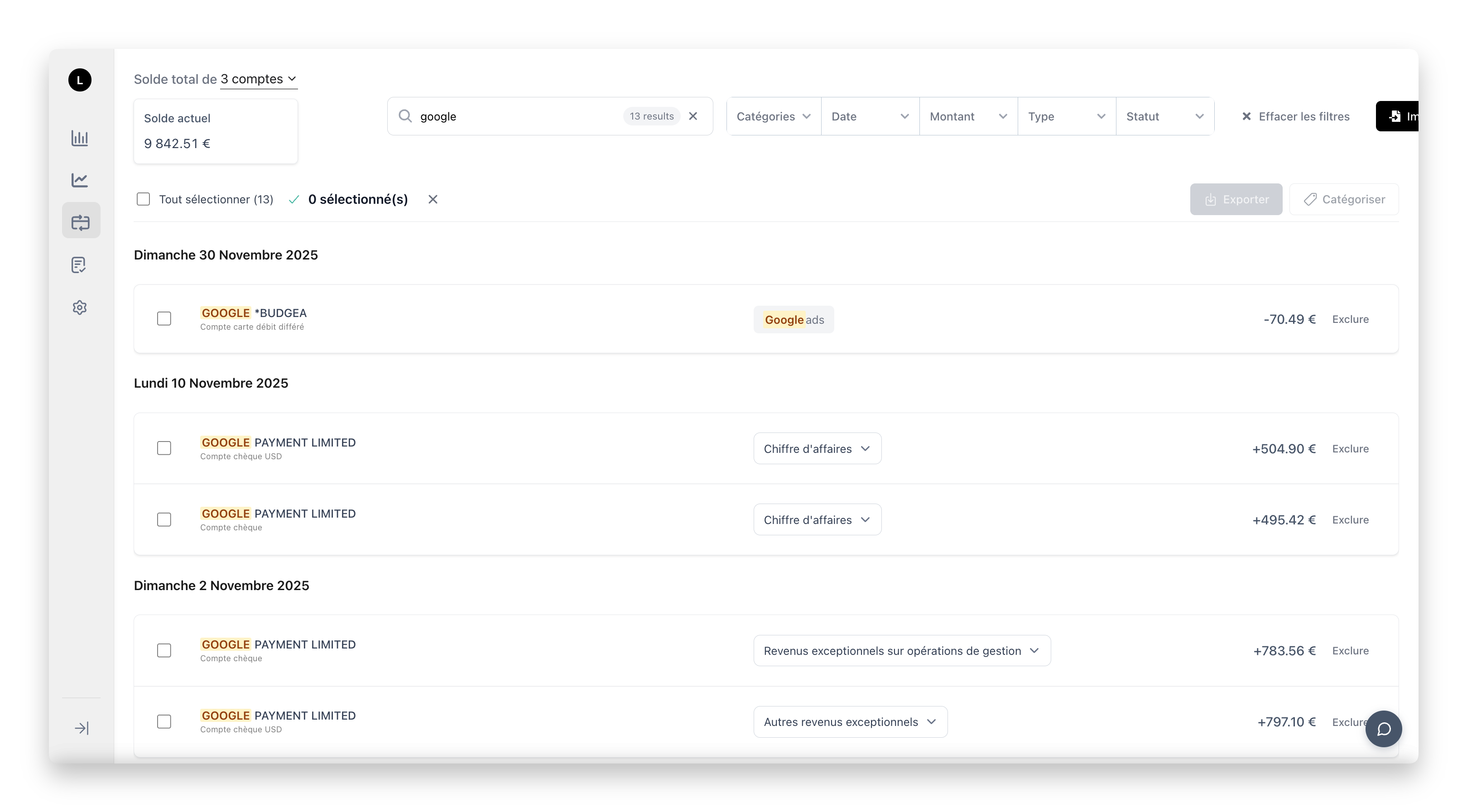

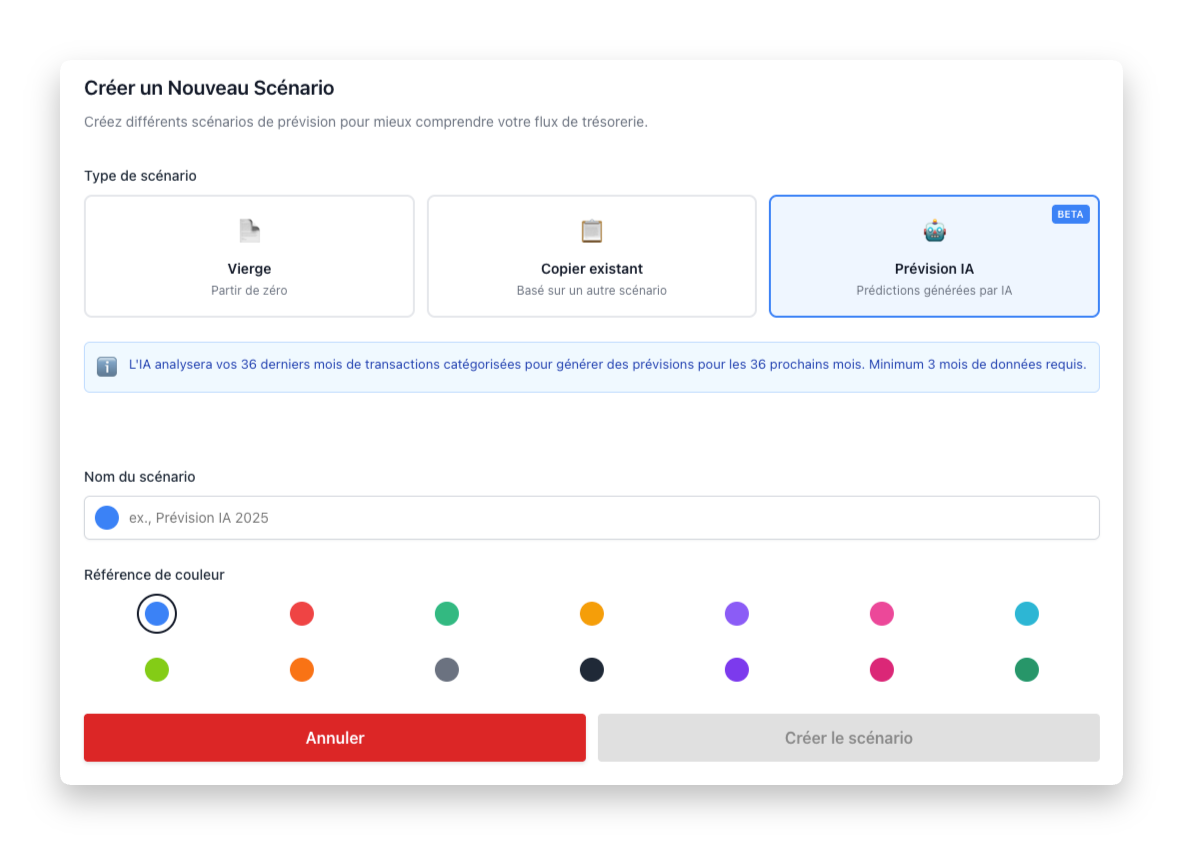

- Implement cash flow management software with real-time visibility

- Review and optimise inventory replenishment parameters

- Explore invoice financing options for flexibility

Conclusion

Manufacturing cash flow management requires careful attention to the entire cash conversion cycle—from purchasing materials through production to collecting payment from customers. The capital-intensive nature of manufacturing means that working capital management isn't just a finance function; it's a strategic imperative.

By optimising inventory levels, negotiating effective supplier terms, improving customer collection, and building appropriate cash reserves, you can strengthen your manufacturing business against economic fluctuations and invest in the growth opportunities that come your way.

Start taking control of your manufacturing cash flow today—your business resilience and competitive position depend on it.