Consulting Cash Flow Guide 2026

Why Cash Flow Matters for Consultancies

Consulting businesses face distinctive cash flow challenges that differ from product-based or retail businesses. According to the MCA, average payment terms in UK consulting are 42 days, but actual payment often takes 60-90 days for larger corporate clients.

The consulting business model—selling expertise and time—creates a fundamental cash flow tension: your primary cost (staff salaries) is fixed and must be paid monthly, while your revenue arrives in lumps based on project timing and client payment behaviour.

- Service-based revenue means no inventory to manage, but also no physical assets to use as collateral for financing

- Project-based income creates revenue volatility between engagements; feast-or-famine is common

- High fixed costs—salaries typically represent 50-65% of revenue and must be paid regardless of billable work

- Long payment cycles—corporate clients often pay 60-90 days after invoice, creating significant working capital needs

- Utilisation fluctuations—consultants aren't billable 100% of the time; bench time costs money

- IR35 considerations—tax treatment impacts cash flow for contractor-based models; inside-IR35 requires PAYE

- Seasonal patterns—consulting often slows in August and December; clients delay projects around holidays

- Delayed starts—projects signed in Q4 often don't begin until January; revenue recognition delayed

Research by the Federation of Small Businesses shows that 62% of UK consulting firms have experienced late payment, with the average late payment being 27 days overdue.

In consulting, your biggest asset walks out the door every evening. If you can't pay your people, your business evaporates overnight. I've seen firms with £1 million in outstanding invoices struggle to make payroll. Cash flow management isn't optional—it's existential. — UK Consulting Firm Partner

Understanding Consulting Cash Flow Dynamics

The consulting cash flow model has unique characteristics that require specific management approaches.

Revenue Recognition vs Cash Receipt

Consulting creates a significant timing gap between work performed and cash received:

- Week 1-4: Work performed, costs incurred (salaries, travel expenses, subcontractors)

- Month end: Invoice raised for work completed (time-and-materials) or milestone achieved (fixed-price)

- +30-60 days: Standard contractual payment terms

- +60-90 days: Actual payment received (typical for large corporates after approval processes)

This timeline means you could be funding 3 months of staff costs before receiving payment for work done in month one. For a 10-person firm with £80K monthly payroll, that's £240K of working capital tied up.

The Consulting Cash Gap

Calculate your cash gap:

Cash Gap = Days from Incurring Costs to Receiving Payment

Example: Consultant works in January, invoice raised 31 January, 45-day payment terms, client pays 15 days late:

- Work period: 1-31 January

- Invoice date: 31 January

- Payment due: 17 March (45 days)

- Actual payment: 1 April (15 days late)

- Cash gap: Up to 90 days from start of work to payment

Cash Inflows for Consulting Firms

- Project fees (time and materials): Billed monthly based on hours worked at agreed rates

- Project fees (fixed price): Billed at milestones or monthly instalments

- Retainer fees: Monthly recurring revenue for ongoing advisory relationships

- Success fees: Performance-based payments on completion (e.g., percentage of savings achieved)

- Expense reimbursement: Travel, accommodation, and out-of-pocket costs (often at cost-plus)

- Advance payments: Upfront payments for fixed-price or retainer engagements (excellent for cash flow)

Cash Outflows for Consulting Firms

Fixed Costs (typically 60-75% of revenue)

- Staff salaries and benefits: 50-65% of revenue; your largest and most inflexible cost

- Office rent and utilities: 5-10% of revenue (lower with hybrid working)

- Professional indemnity insurance: 1-3% of revenue; essential and often required by clients

- Software and technology: 2-5% of revenue (CRM, project management, productivity tools)

- Professional memberships and training: 1-2% of revenue; important for credibility

Variable Costs (typically 10-25% of revenue)

- Subcontractor/associate fees: Variable based on demand; typically 60-80% of client charge rate

- Travel and entertainment: 3-8% of revenue (higher for client-facing roles)

- Marketing and business development: 2-5% of revenue (events, content, lead generation)

- Recruitment fees: Variable; typically 15-25% of first-year salary per hire

Billing Strategies for Better Cash Flow

How you structure and deliver your billing directly impacts cash flow. Smart billing practices can significantly reduce working capital requirements.

Time and Materials vs Fixed Price

Time and Materials Billing

- How it works: Bill clients based on hours worked at agreed day/hour rates

- Pros: Flexibility, get paid for all work performed, no scope risk, simpler to manage

- Cons: Client budget uncertainty, harder to forecast revenue, clients may push back on hours

- Cash flow impact: Regular monthly billing creates predictable invoicing cycle

Fixed Price Billing

- How it works: Agree total fee upfront for defined scope of work

- Pros: Predictable revenue, can optimise delivery for higher profit, clients like budget certainty

- Cons: Scope creep risk, potential for losses if scope expands, requires accurate estimating

- Cash flow impact: Can structure for upfront or milestone payments; better cash flow potential

Best Practice: Hybrid Approach

Many successful consultancies use hybrid billing:

- Fixed fee for defined deliverables plus time and materials for additional scope

- Fixed fee with change order mechanism for scope expansion

- Capped time and materials—bill hourly up to a maximum

Retainer Models

Retainers provide predictable cash flow and are highly valuable for consulting businesses:

- Fixed monthly retainer: Set hours or scope each month; paid in advance or arrears

- Use-it-or-lose-it: Client pays for availability regardless of actual usage; excellent for cash flow

- Rollover retainer: Unused hours roll forward; more client-friendly but creates liability

- Annual retainer: Annual commitment paid quarterly or annually in advance; best for cash flow

Billing Frequency Optimisation

- Bill weekly if possible: Some clients accept weekly billing; reduces cash gap significantly

- Bill on milestones: For fixed-price, structure milestones to front-load cash receipt

- Bill immediately: Invoice the day work is complete or month ends; don't delay

- Advance billing: For retainers, invoice in advance for the upcoming period

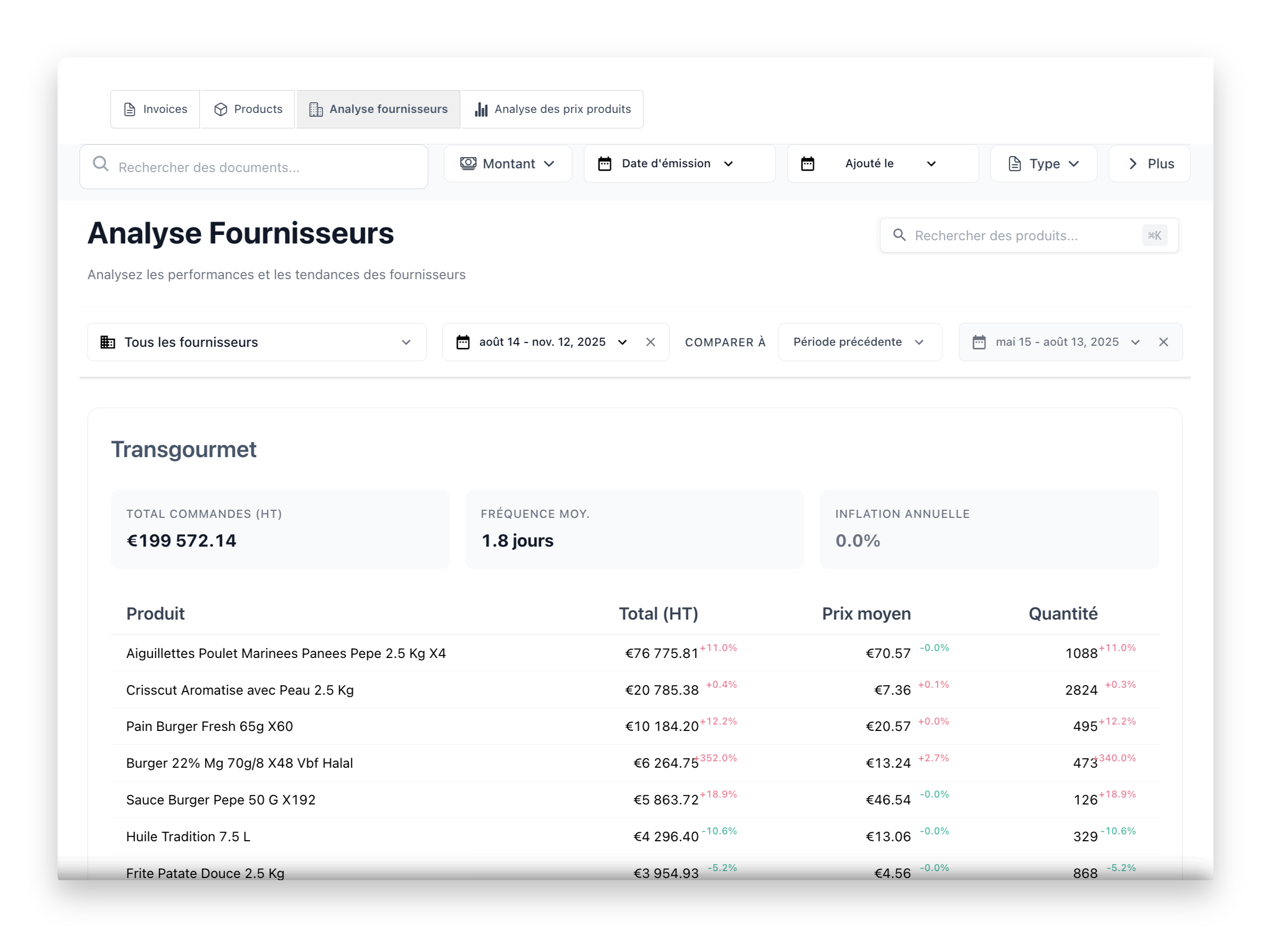

Managing Payment Terms and Collections

Standard UK Consulting Payment Terms

Payment terms vary significantly by client type:

- SME/entrepreneur clients: 14-30 days; often pay promptly

- Boutique/mid-market corporates: 30-45 days; reasonable compliance

- Large corporates (FTSE 250+): 45-60 days contractual (some demand 90-120); often pay late

- Public sector: 30 days contractual; often longer in practice due to PO and approval processes

- Private equity backed: Varies widely; some pay quickly, others stretch terms

Improving Payment Collection

- Invoice immediately: Don't wait until end of month if you can invoice earlier

- Use client procurement portals: Register and submit through Ariba, Coupa, etc. promptly

- Clear, detailed invoices: Include PO numbers, project references, contact details

- Name the approver: Build relationship with client finance/AP team

- Early payment discounts: Offer 2% for payment within 10 days (2/10 Net 30)

- Automated payment reminders: Set up reminders at 7, 14, 21, and 28 days overdue

- Escalation process: Defined process for escalating to client sponsor when overdue

- Credit checks: Check new clients before agreeing extended terms

Handling Slow-Paying Clients

- Address early: Don't let invoices age; chase from day 1 overdue

- Understand root cause: Is it process issue, budget issue, or intentional?

- Leverage relationships: Project sponsors can often accelerate payment

- Adjust future terms: Require advance payment or shorter terms for repeat offenders

- Consider firing: Some clients aren't worth the cash flow stress

Managing Utilisation and Capacity

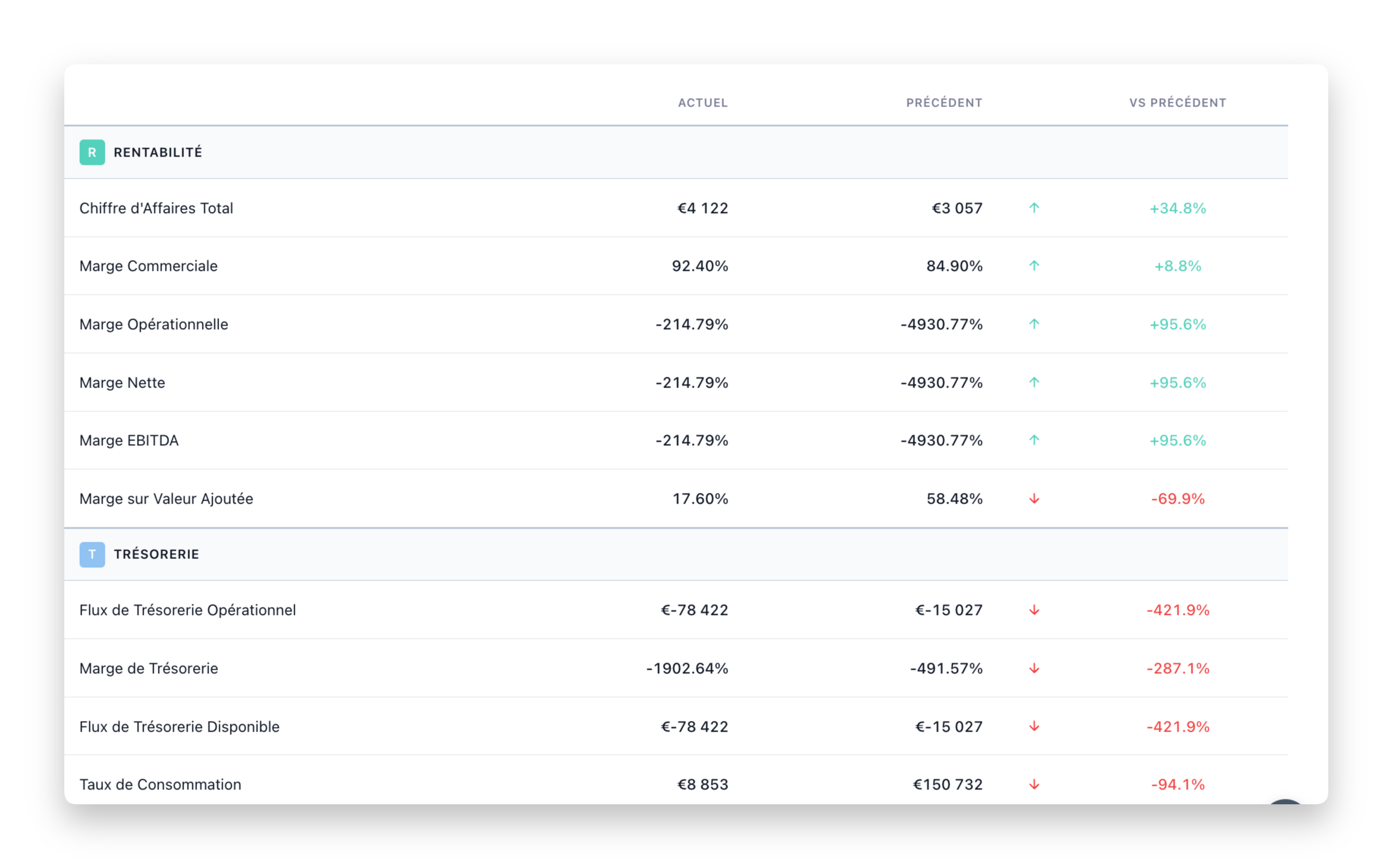

Utilisation—the percentage of available time that generates billable revenue—directly determines profitability and cash flow.

Understanding Utilisation

Utilisation Rate = Billable Hours ÷ Available Hours × 100

UK consulting benchmarks:

- Target utilisation (consultants): 65-75%

- Target utilisation (managers): 55-65%

- Target utilisation (partners/directors): 40-50% (more business development time)

- Available hours: Typically 1,800-2,000 per year (after holidays, training, admin)

- Break-even utilisation: Calculate the minimum utilisation needed to cover costs

The Cash Flow Impact of Utilisation

Low utilisation destroys cash flow because costs continue while revenue drops:

- At 70% utilisation: Revenue covers costs plus profit margin

- At 50% utilisation: Revenue may only cover direct costs

- At 30% utilisation: Cash burn accelerates rapidly

Managing Utilisation Fluctuations

- Pipeline management: Maintain 3-6 months of visible opportunities; forecast utilisation forward

- Flexible workforce: Use associates/contractors for peak demand; scale down in troughs

- Internal projects: Use downtime productively (IP development, marketing, training)

- Cross-selling: Extend existing engagements where possible; easier than new sales

- Secondments: Place consultants with clients on interim basis during slow periods

- Managed bench: Accept some non-billable time for training and development

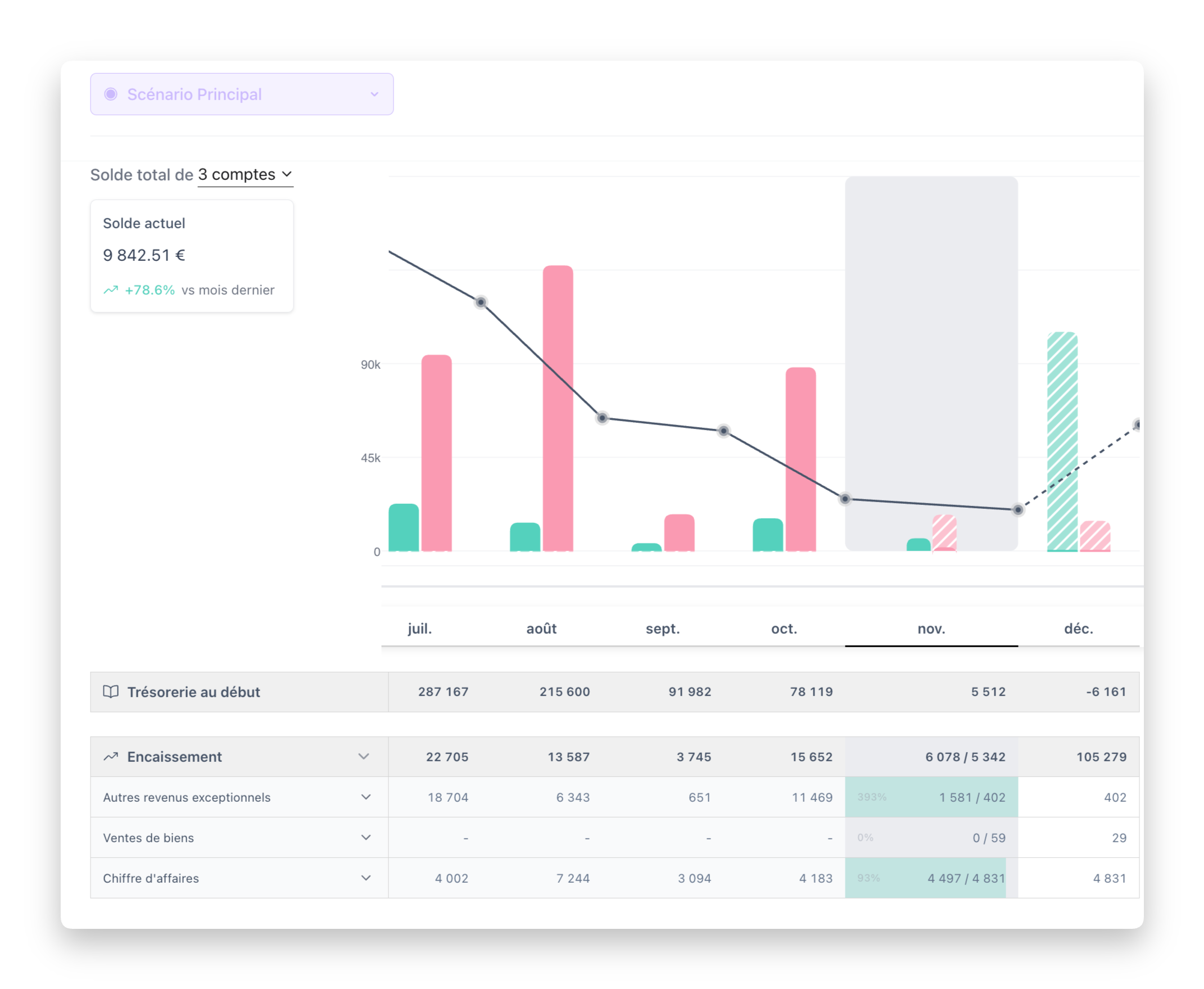

Cash Flow Forecasting for Consulting

Revenue Forecasting by Probability

Build your revenue forecast using weighted probabilities:

- Committed revenue (100%): Signed contracts and ongoing engagements

- High probability (75-90%): Verbal agreements, contracts in signature

- Probable revenue (50-70%): Proposals submitted, strong engagement

- Pipeline revenue (20-40%): Opportunities in discussion, RFP stage

- Possible revenue (10-20%): Early-stage opportunities, repeat client potential

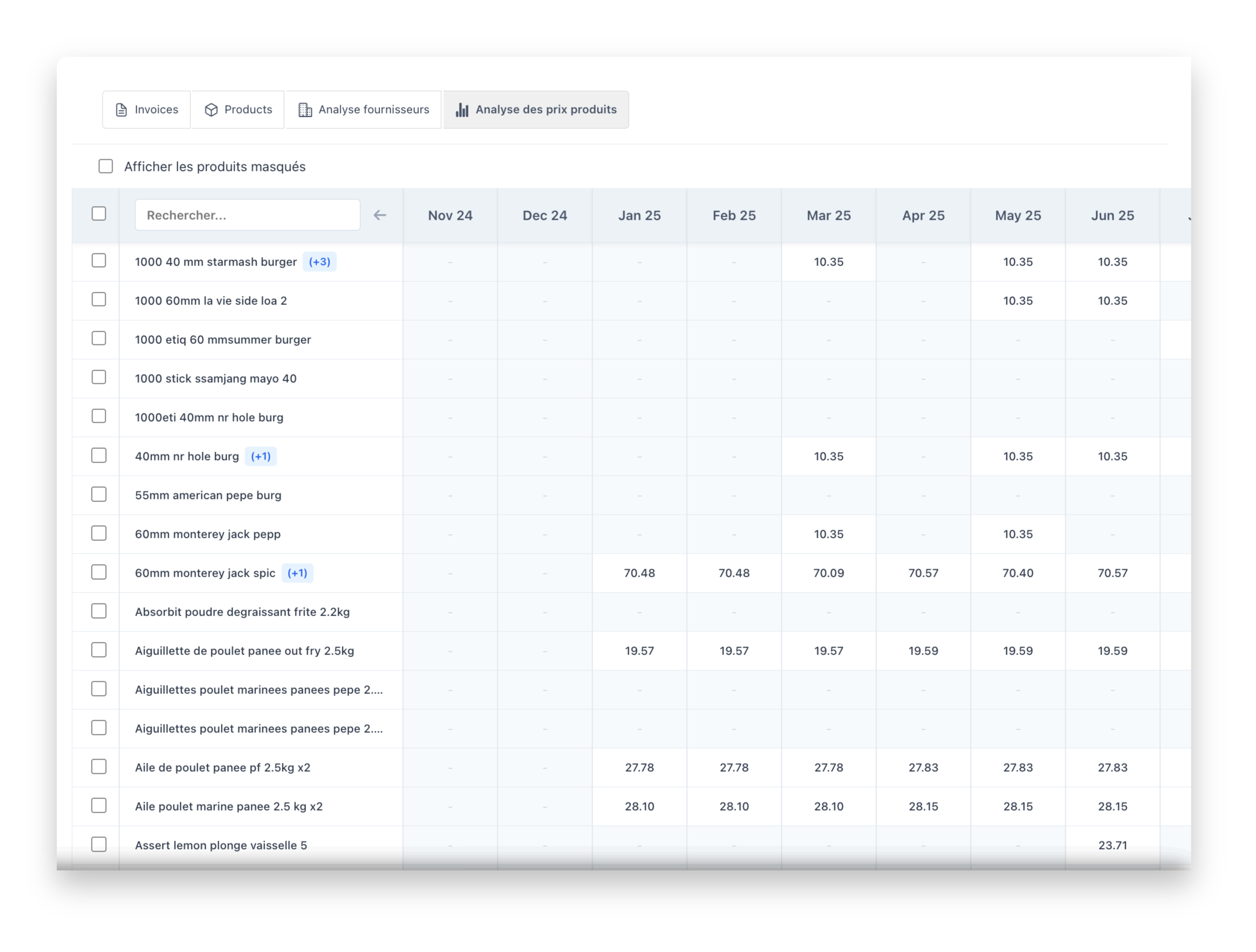

Expense Forecasting

- Fixed costs: Salaries, rent, insurance—predictable monthly

- Variable costs: Subcontractors (tied to revenue), travel (tied to projects)

- Periodic costs: Insurance renewals, bonus payments, recruitment

- Growth costs: New hires (cost before revenue), new office, expanded capabilities

Scenario Planning

- Base case: Expected pipeline conversion, current utilisation trends

- Upside: All proposals convert, no churn, early project starts

- Downside: Key project delayed, proposal losses, client budget cuts

- Stress test: Major client loss, market downturn scenario

Working Capital Management

Calculating Working Capital Needs

Consulting firms need working capital to fund the gap between paying costs and receiving revenue:

Working Capital Need = Monthly Operating Costs × Average Days to Payment ÷ 30

Example: £200K monthly costs, 60-day average payment = £400K working capital required

Building Cash Reserves

- Minimum reserve: 3 months of operating costs

- Comfortable reserve: 6 months of operating costs

- Build during good times: Set aside 10-15% of profit during high-utilisation periods

- Separate reserve account: Keep reserves visible but separate from operating cash

Financing Options for Consultancies

- Invoice factoring: Advance 80-90% of invoice value immediately; useful for large receivables

- Business overdraft: Flexible facility for timing gaps; essential working capital tool

- Credit line: Pre-approved borrowing facility for lumpy cash flow

- R&D tax credits: Cash-back on qualifying innovation work (applies to many consulting firms)

Warning Signs of Cash Flow Problems

Watch for these red flags:

- Increasing debtor days: Clients taking longer to pay

- Growing WIP: More unbilled time accumulating

- Declining utilisation: Less billable work in the pipeline

- Delayed supplier payments: Stretching your own payments to conserve cash

- Using personal funds: Partners injecting personal cash to cover shortfalls

- Payroll stress: Uncertainty about meeting payroll dates

- Declining reserves: Cash buffer eroding month over month

Key Consulting Cash Flow Metrics

Track these metrics regularly:

- Debtor days (DSO): Average collection time (target: under 45 days)

- Utilisation rate: Percentage of billable time (target: 65-75% for consultants)

- Revenue per consultant: UK average £150-200K for established firms

- Profit per partner: Key metric for partner-led firms

- Cash runway: Months of overhead coverage in reserve (target: 3-6 months)

- Work in progress: Unbilled time—cash tied up awaiting invoicing

- Lock-up days: WIP days + debtor days = total cash tied up

- Pipeline coverage: Ratio of pipeline to revenue target (aim for 3x or higher)

Action Steps for Better Consulting Cash Flow

This Week

- Review all outstanding invoices and chase any overdue amounts

- Calculate current debtor days across all clients

- Check utilisation rates for last 3 months by consultant

- Review unbilled WIP and raise any outstanding invoices

- Identify your three slowest-paying clients

This Month

- Implement automated payment reminders at 7, 14, and 21 days

- Review billing terms with slow-paying clients; negotiate improvements

- Build 13-week rolling cash flow forecast

- Review subcontractor payment timing for better alignment

- Explore retainer arrangements with ongoing clients

This Quarter

- Build 3-month cash reserve if not already in place

- Review pricing to ensure adequate margins for cash flow

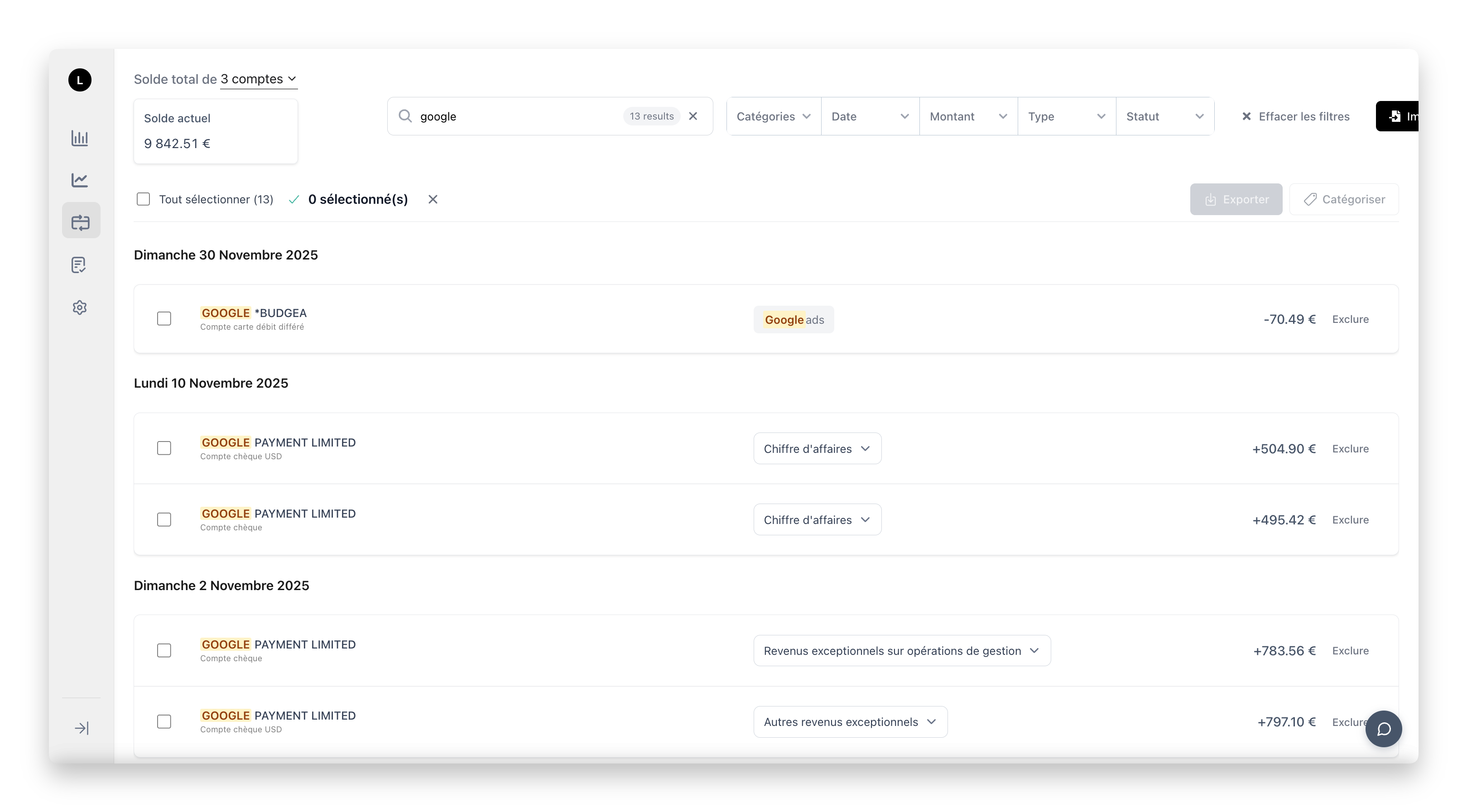

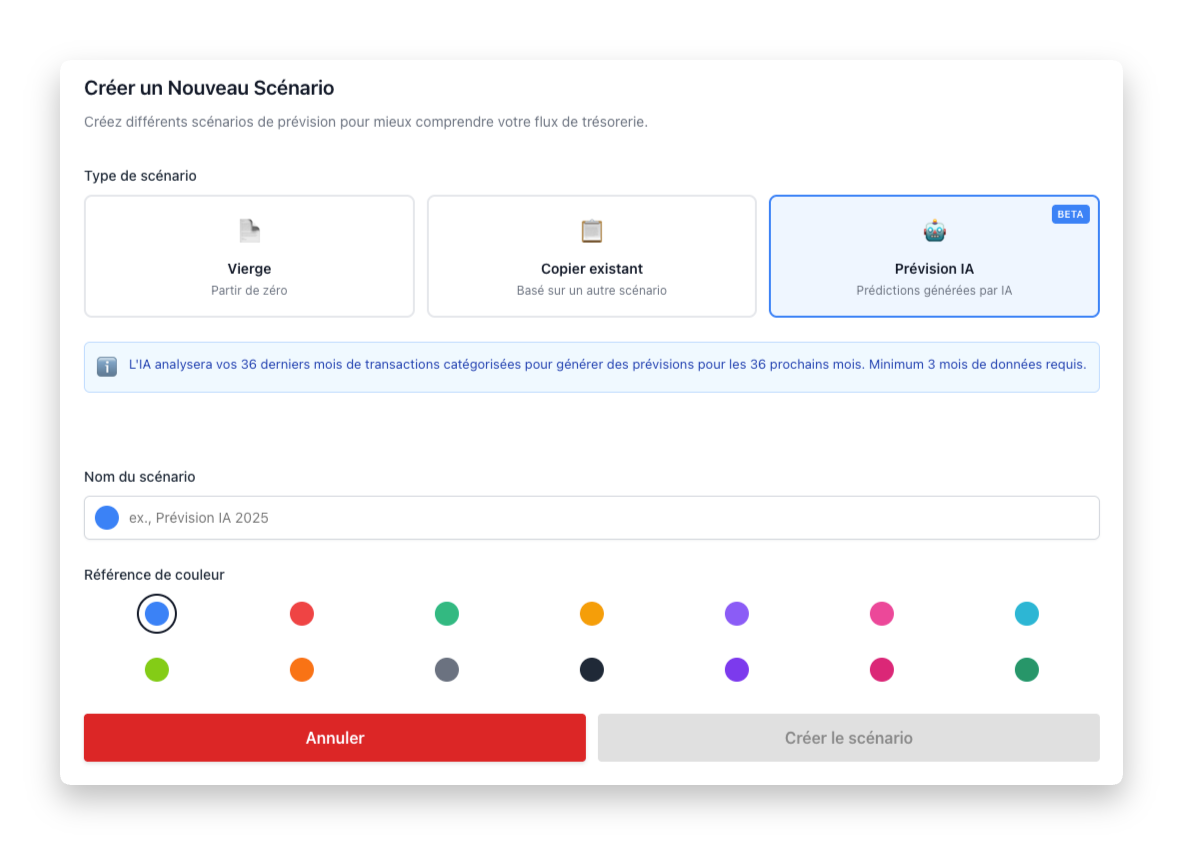

- Implement cash flow management software with forecasting

- Develop flexible workforce model for demand management

- Review client portfolio for cash flow quality

Conclusion

Consulting cash flow management centres on managing the gap between work performed and payment received. The service-based model—where your primary cost (people) is fixed while revenue varies with utilisation and collection timing—requires careful attention.

By optimising billing practices, improving collection processes, managing utilisation effectively, and maintaining adequate cash reserves, you can build a more resilient consulting business that survives the inevitable fluctuations in project work and client payment behaviour.

Start taking control of your consulting cash flow today—your firm's stability and growth potential depend on it.