Prodotti

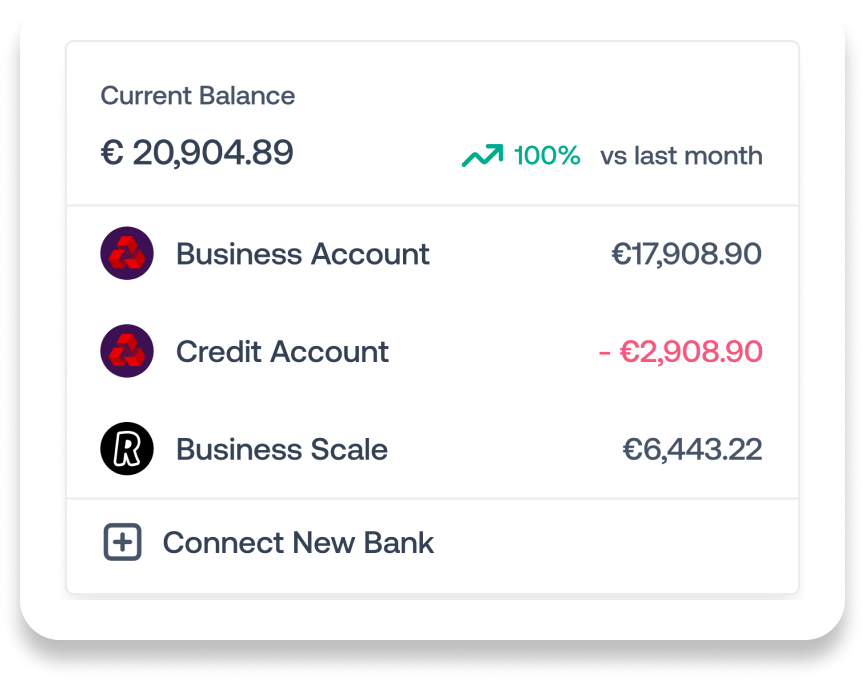

Gestione Flusso di Cassa

Sincronizzazione giornaliera automatica e previsioni con IA

Analisi delle Prestazioni e KPI

P&L, KPI e insights finanziari completi

Calcolatore di Pareggio

Analisi interattiva del punto di pareggio e pianificazione della redditività

Hub di Gestione Documenti

Gestione intelligente di fatture e ricevute con IA

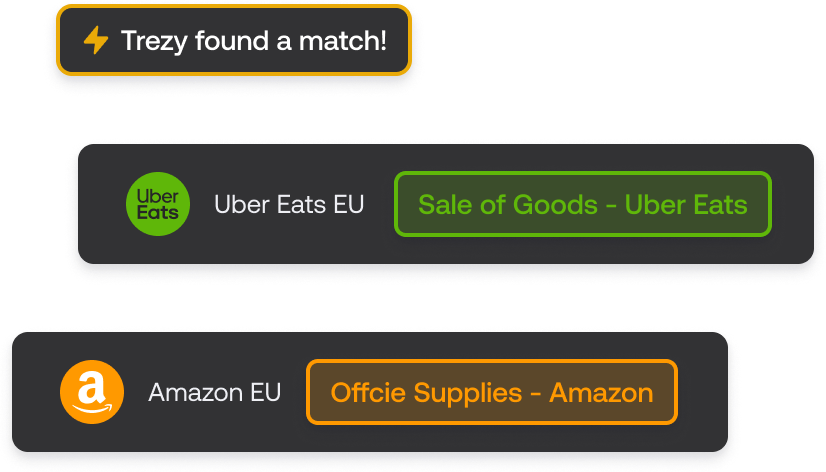

Gestione Transazioni

Sincronizzazione multi-banca con categorizzazione intelligente

Analisi Fornitori e Intelligence dei Costi

Monitoraggio inflazione in tempo reale e ottimizzazione delle spese